Just in time for the Super Bowl and ahead of IAC’s breakup, Ticketmaster has struck a deal to acquire online ticket scalper TicketsNow for $265 million. This follows eBay’s acquisition of StubHub for $310 million last year. TicketsNow is the second-largest online ticket scalper after StubHub, having sold $200 million worth of tickets in 2006. Sources tell us Ticketmaster first looked at RazorGator for about the same price, but that deal fell through during due diligence. Once they took a look at the books, they passed. The $265 million paid for TicketsNow, we are told by another knowledgeable industry source, is 35 times EBITDA and about 5X revenues (of $60 million).

Just in time for the Super Bowl and ahead of IAC’s breakup, Ticketmaster has struck a deal to acquire online ticket scalper TicketsNow for $265 million. This follows eBay’s acquisition of StubHub for $310 million last year. TicketsNow is the second-largest online ticket scalper after StubHub, having sold $200 million worth of tickets in 2006. Sources tell us Ticketmaster first looked at RazorGator for about the same price, but that deal fell through during due diligence. Once they took a look at the books, they passed. The $265 million paid for TicketsNow, we are told by another knowledgeable industry source, is 35 times EBITDA and about 5X revenues (of $60 million).

Many of the tickets that scalpers, er, brokers, sell on these secondary marketplaces are initially purchased from the Ticketmasters of the world. So the markup is a missed opportunity for Ticketmaster, whose own TicketExchange has shown lackluster performance.

Many of the tickets that scalpers, er, brokers, sell on these secondary marketplaces are initially purchased from the Ticketmasters of the world. So the markup is a missed opportunity for Ticketmaster, whose own TicketExchange has shown lackluster performance.

The TicketsNow deal shows how hot the secondary event ticket market is becoming, and Ticketmaster’s entry will likely help legitimize the sector (see our previous coverage on some of the problems with the industry).

The WSJ, which broke the story, reports (subscription required):

Ticketmaster President and Chief Executive Sean Moriarty said the company plans to share revenue from its new division with clients that own venues or promote events, although he said details on how the money would be distributed aren’t final. He said the move highlights a shift in the way ticket resellers are perceived, both by the public and by concert-industry participants. Where resellers once were viewed as shady scalpers, now, thanks largely to the Internet, they are becoming more respectable.“Clients who five years ago were not willing to allow a ticket to be resold now want a piece of it,” Mr. Moriarty said. The size of the secondary ticket market is hard to judge, but estimates range from $2.5 billion to $5 billion a year in the U.S.

That’s a nice growth market for a business that is about to be spun off as its own stock.

Join 10k+ tech and VC leaders for growth and connections at Disrupt 2025

Netflix, Box, a16z, ElevenLabs, Wayve, Hugging Face, Elad Gil, Vinod Khosla — just some of the 250+ heavy hitters leading 200+ sessions designed to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss the 20th anniversary of TechCrunch, and a chance to learn from the top voices in tech. Grab your ticket before doors open to save up to $444.

Join 10k+ tech and VC leaders for growth and connections at Disrupt 2025

Netflix, Box, a16z, ElevenLabs, Wayve, Hugging Face, Elad Gil, Vinod Khosla — just some of the 250+ heavy hitters leading 200+ sessions designed to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss a chance to learn from the top voices in tech. Grab your ticket before doors open to save up to $444.

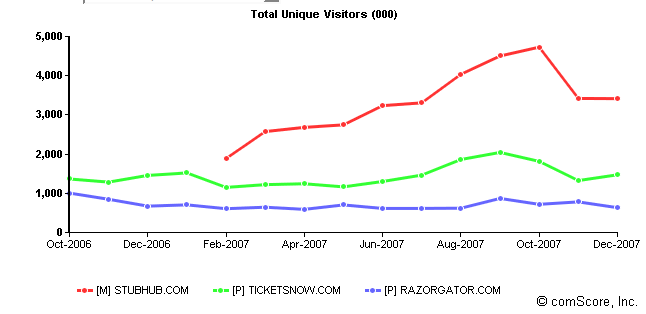

According to comScore, TicketsNow had 1.5 million unique visitors in December, about the same it did a year ago, while StubHub attracted 3.4 million and has been growing nicely under eBay’s wing (although it took a major hit in November).