AOL just released its financial results for 2009, its first as a standalone company since October 2000.

AOL just released its financial results for 2009, its first as a standalone company since October 2000.

The company reported a profit of $1.4 million, or a penny a share, compared with a loss of $1.96 billion, or $18.52 a share, a year earlier (when Time Warner wrote down the Internet giant).

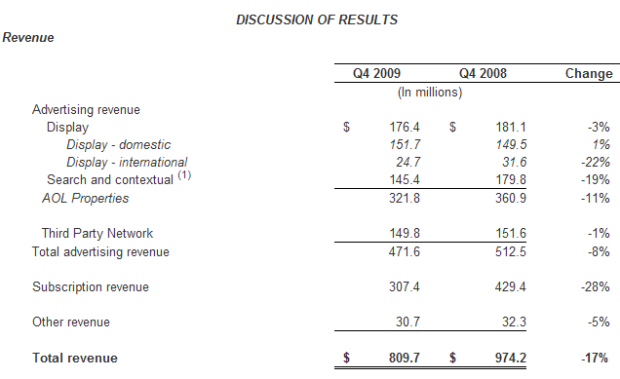

What caught our eye is that revenues are down 17% YOY, dropping from $974 million in Q4 2008 to roughly $810 million in the fourth quarter of last year. Zooming in on advertising revenue, Q4 revenues on that level dropped 8%, from $512.5 million in the fourth quarter of 2008 to $471.6 million in Q4 2009.

Nevertheless, results beat Wall Street expectations, particularly because they were notably low across the board.

AOL says Q4 revenue declines reflect continued attrition in the subscriber base, leading to declines in subscription and search & contextual revenue (which dropped 19%). AOL Properties’ global display advertising revenue dropped 3% YOY, but the company points out domestic display advertising revenue actually grew 1%. We’ll see if that trend continues.

AOL had $147 million of cash-on-hand as of December 31, 2009.

AOL Chairman & CEO Tim Armstrong in a statement said the company is entering 2010 with a “clearly defined strategy” and “incredibly focused on day-to-day execution.”

Join 10k+ tech and VC leaders for growth and connections at Disrupt 2025

Netflix, Box, a16z, ElevenLabs, Wayve, Hugging Face, Elad Gil, Vinod Khosla — just some of the 250+ heavy hitters leading 200+ sessions designed to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss the 20th anniversary of TechCrunch, and a chance to learn from the top voices in tech. Grab your ticket before doors open to save up to $444.

Join 10k+ tech and VC leaders for growth and connections at Disrupt 2025

Netflix, Box, a16z, ElevenLabs, Wayve, Hugging Face, Elad Gil, Vinod Khosla — just some of the 250+ heavy hitters leading 200+ sessions designed to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss a chance to learn from the top voices in tech. Grab your ticket before doors open to save up to $444.

Needless to say, 2010 will be a turn-around year for Armstrong & co, and probably not the end of it. The company is losing long-time executives almost daily now, but it has a clear, much-discussed focus on turning AOL into a highly effective, profitable low-cost, high-volume content machine.

Time will tell if this niche content strategy ends up having a positive effect on ad display revenues in the coming years.