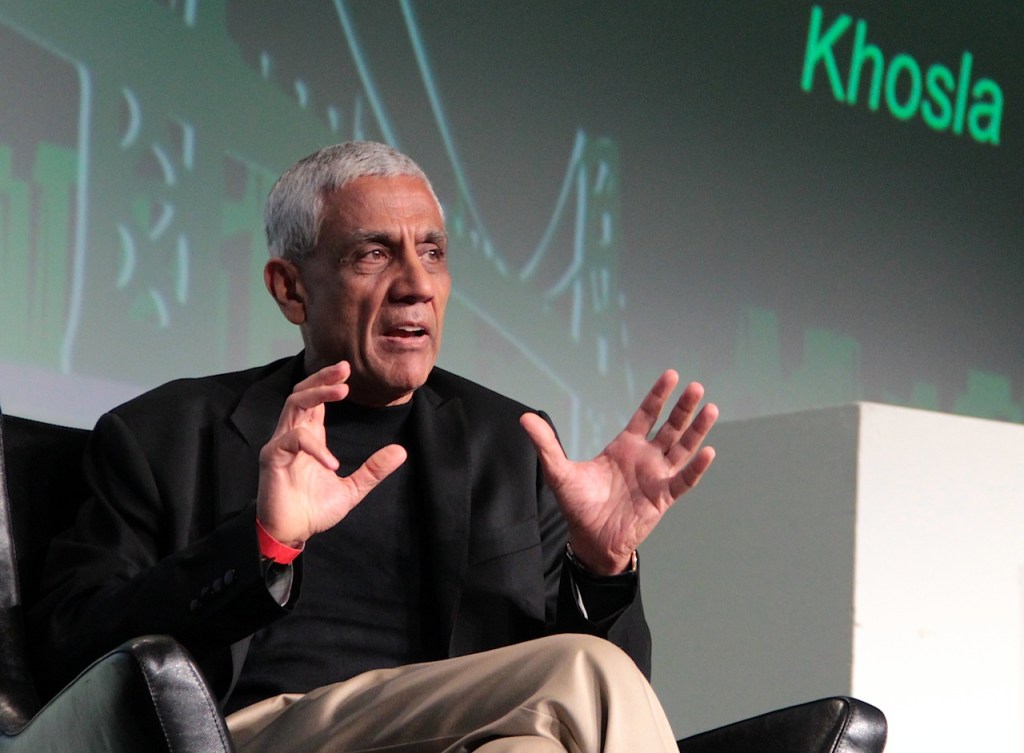

Michael Arrington hopped on stage at TechCrunch Disrupt SF for a fireside chat with Vinod Khosla of Khosla Ventures, a very prominent VC firm in Silicon Valley. The two discussed Khosla’s perspective on how companies within his firm’s portfolios get the most out of working with the team.

Khosla is very passionate about assisting his companies with recruiting, even suggesting that talented folks send him their resume.

Khosla went on to discuss what happens when you hire the wrong people, and he says that it’s hard to get a team back on track once those mistakes are made early on.

I spend most of my time recruiting for my companies. You hire the first 15 people and they hire the rest.

As Khosla discussed his practices, he says that it sets them apart from the rest of their competition. Khosla Ventures participates in way more than just investing in many different verticals. Helping companies grow for success makes complete sense, since the firm gets to reap the rewards in the end…hopefully.

Not only is it about hiring the “right” people, but as Khosla has said here on TechCrunch before, you don’t have to be a jerk to be successful. Finding the right spot for someone in a company is key:

If people aren’t performing, put them in the another job where they can perform or fire them.

Join 10k+ tech and VC leaders for growth and connections at Disrupt 2025

Netflix, Box, a16z, ElevenLabs, Wayve, Hugging Face, Elad Gil, Vinod Khosla — just some of the 250+ heavy hitters leading 200+ sessions designed to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss the 20th anniversary of TechCrunch, and a chance to learn from the top voices in tech. Grab your ticket before doors open to save up to $444.

Join 10k+ tech and VC leaders for growth and connections at Disrupt 2025

Netflix, Box, a16z, ElevenLabs, Wayve, Hugging Face, Elad Gil, Vinod Khosla — just some of the 250+ heavy hitters leading 200+ sessions designed to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss a chance to learn from the top voices in tech. Grab your ticket before doors open to save up to $444.

Disruption is key as well, as some of Khosla’s portfolio companies have taken on the biggest and most difficult problems in the world. On Khosla’s investment on payment service Square:

If you said to someone three years ago that you could compete against PayPal, most people would say that’s a crazy idea, payments are done.

Some of the new things that Khosla’s firm is getting into is the consumerization of healthcare, and he has discussed some of the new companies he’s investing in, including smart chips and apps that help you track your vital signs.

At the end of the day, Vinod Khosla doesn’t even like to refer to himself as a venture capitalist:

I don’t consider myself a VC, I consider myself a mentor.

Other organizations clearly do things differently, including Y Combinator. Give this piece a read for more details:

I Feel Sad Sometimes For Y Combinator Companies That Get So Much Hype