Bitcoin, the cryptocurrency on everyone’s mind, is booming in value. Currently trading around $645 per coin, it has never been worth more, or generated more headlines that I can recall. The two are likely connected.

If you can remember April, Bitcoin enjoyed a firm rally, spiking to around $275 per coin on the Mt.Gox market. It then fell to the $60s. That was the second Bitcoin rally. The first was quite a while ago, in June of 2011 according to the same dataset, with Bitcoin spiking to a then sky-high $30 or so. It later fell to the single digits.

And so, in the first two Bitcoin rallies, we saw short-term spikes followed by sharp declines and price troughs. The gap between Bitcoin Rally 1 and Bitcoin Rally 2 was far longer than the distance between Rally 2 (April) and Rally 3 (now), but the pattern appears to be about the same.

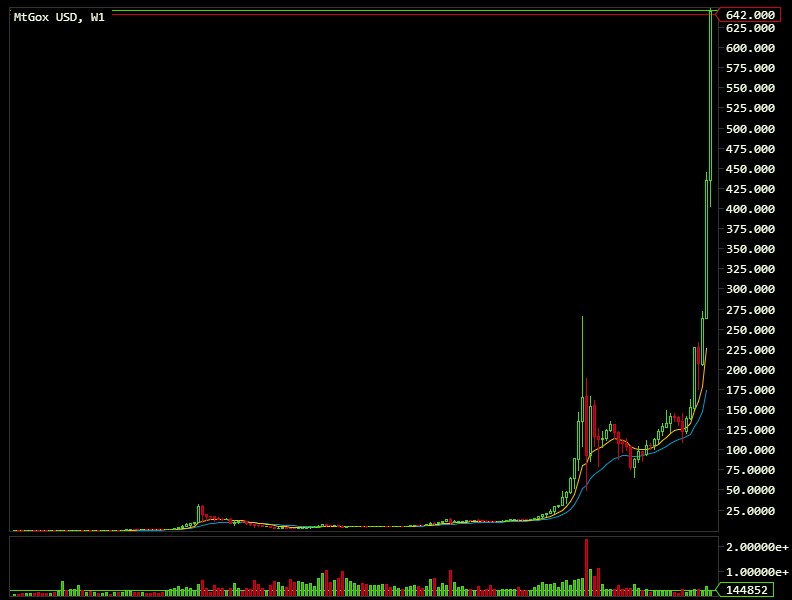

And oh, darling is Bitcoin putting on a show. For perspective, here’s a weekly Bitcoin chart, starting around July in 2010, to today:

Kaboom, essentially.

The current rally is being fueled by the usual combination of presumed scarcity, an overzealous investor class, and truckloads of optimism. So, things will calm down in a bit, with a decent price correction. History teaches us that much. Also, can I sell you this tulip bulb.

Join 10k+ tech and VC leaders for growth and connections at Disrupt 2025

Netflix, Box, a16z, ElevenLabs, Wayve, Hugging Face, Elad Gil, Vinod Khosla — just some of the 250+ heavy hitters leading 200+ sessions designed to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss the 20th anniversary of TechCrunch, and a chance to learn from the top voices in tech. Grab your ticket before doors open to save up to $444.

Join 10k+ tech and VC leaders for growth and connections at Disrupt 2025

Netflix, Box, a16z, ElevenLabs, Wayve, Hugging Face, Elad Gil, Vinod Khosla — just some of the 250+ heavy hitters leading 200+ sessions designed to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss a chance to learn from the top voices in tech. Grab your ticket before doors open to save up to $444.

Bitcoin was given a boost of sorts recently from the words of Ben Bernanke, chairman of the Federal Reserve, speaking to Congress in epistolary format:

[T]hese types of innovations [such as Bitcoin] may pose risks related to law enforcement and supervisory matters, there are also areas in which they may hold long-term promise, particularly if the innovations promote a faster, more secure and more efficient payment system.

So that didn’t hurt. There is fear in the market that regulation of Bitcoin by the government could make it less anonymous, stripping it of one of its most important tenets. For now, however, on goes Bitcoin.

Buy another monitor, toss a chart on it. This is going to get fun.

Top Image Credit: Flickr