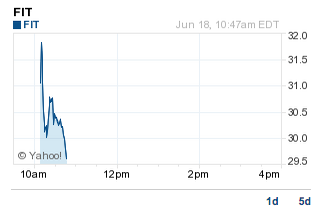

Fitbit went public this morning, soaring more than 50 percent at one moment. The wearables firm priced its equity at $20 per share. Early trading saw the shares crest the $30 mark.

At the time of writing, Fitibit is currently trading for $29.60, a 48 percent gain. Regardless, the company is having the sort of debut that most startups dream of. It’s worth keeping in mind that Fitbit originally proposed a $14 to $16 share price for its flotation. As such, it’s even further ahead than some perhaps expected.

This chart is the porn you were looking for:

Originally, Fitbit filed for a $100 million public offering. That figure — often a placeholder — rose to $358 million, using its original share pricing. The company raised even more today. In short, whatever Fitbit had planned for that money it can do, and more.

The company’s finances are in good shape. Fitbit sports rising revenues, and growing profits. If that fact sounds odd, keep in mind that not all IPOs are designed for cash-strapped companies looking for new monies. That’s to say that 2014 and 2015 are predicated on things other than margins, but that’s another post.

We’ll have more at closing time, but for now it is safe to say that Fitbit’s share are fit in the sense of the British slang.

Join 10k+ tech and VC leaders for growth and connections at Disrupt 2025

Netflix, Box, a16z, ElevenLabs, Wayve, Hugging Face, Elad Gil, Vinod Khosla — just some of the 250+ heavy hitters leading 200+ sessions designed to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss the 20th anniversary of TechCrunch, and a chance to learn from the top voices in tech. Grab your ticket before doors open to save up to $444.

Join 10k+ tech and VC leaders for growth and connections at Disrupt 2025

Netflix, Box, a16z, ElevenLabs, Wayve, Hugging Face, Elad Gil, Vinod Khosla — just some of the 250+ heavy hitters leading 200+ sessions designed to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss a chance to learn from the top voices in tech. Grab your ticket before doors open to save up to $444.

A final note: Every strong venture capital-backed IPO at this point is a fruit basket from the god of liquidity. The venture world is thirsty in a number of contexts, but when it comes to exits, such things are akin to mimosas in the desert. So, this IPO doesn’t do much but further our current bubble.

Viva!