For investors of Zulily, today is a good day. The company has agreed to be acquired by the parent company of QVC in a roughly $2.4 billion deal. The agreement values Zulily at $18.75 per share, up nearly 50 percent from its prior close.

Temper your excitement. When Zulily went public, it sold 11 million shares at $22 apiece. As TechCrunch wrote at the time, the online deal shop had a massive first day, spiking as high as $41.32. Things have since declined.

Certainly, exiting is to be commended for a company if it can unlock significant value, as in this case. But to exit the public sphere underwater from your IPO price is hardly a triumphant march.

To that end, Fortune’s Dan Primack wrote today that the decline of Zulily could toss cold water on the larger technology IPO market. Noting that while a number of its venture backers did quite well by themselves, in the context of a cadre of other recent, lackluster IPOs, Primack said that the “disappointments are beginning to pile up.”

Another prior high-flyer in the e-commerce space, Groupon, is now worth a fraction of the $6 billion that Google once offered for it. That’s a longer-term deflation, but if you compare the charts and lean your head just right, well, you get the idea.

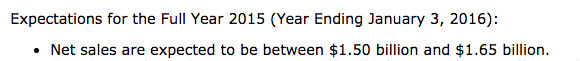

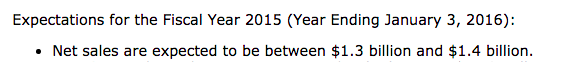

Zulily grew its revenue from $696 million in 2013 to $1.2 billion in 2014. While that growth was impressive, the firm cut its full-year 2015 guidance dramatically in a recent earnings report. See if you can spot the difference between its fourth quarter 2014 report and its first quarter 2015 report:

2014:

Join 10k+ tech and VC leaders for growth and connections at Disrupt 2025

Netflix, Box, a16z, ElevenLabs, Wayve, Hugging Face, Elad Gil, Vinod Khosla — just some of the 250+ heavy hitters leading 200+ sessions designed to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss the 20th anniversary of TechCrunch, and a chance to learn from the top voices in tech. Grab your ticket before doors open to save up to $444.

Join 10k+ tech and VC leaders for growth and connections at Disrupt 2025

Netflix, Box, a16z, ElevenLabs, Wayve, Hugging Face, Elad Gil, Vinod Khosla — just some of the 250+ heavy hitters leading 200+ sessions designed to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss a chance to learn from the top voices in tech. Grab your ticket before doors open to save up to $444.

2015:

In case you are having a coffee-free day, the second set of numbers is smaller. Telling investors that you expect $100 million to $350 million less in revenue during the year than before means less profit. And less profit means that the firm itself is less valuable. And down goes its public worth.

So, while today is a good day for people holding shares of Zulily as of last Friday, it remains a slightly bittersweet exit. Still, it’s hard to come down too hard on a $2.4 billion deal.