The latest smartphone sales data from Kantar Worldpanel suggests Apple had a tougher time shifting its devices over Chinese New Year than in prior years, with the market watcher noting no growth in marketshare for iOS over the three months ending February 2016 — the first time since August 2014 that Apple has not grown share in urban China, according to its data.

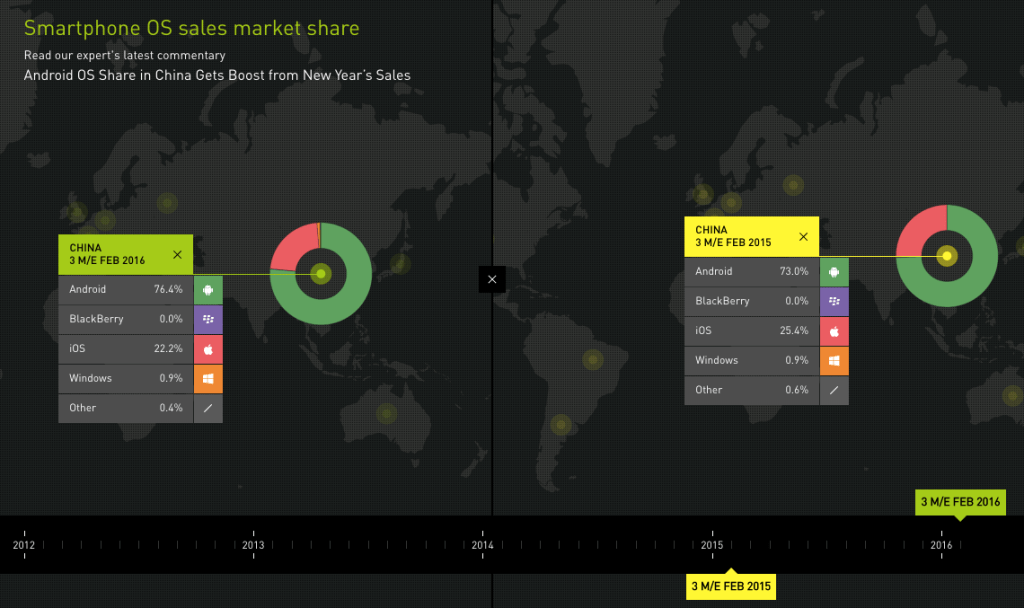

Between February 2015 and February 2016 iOS shed 3.2 percentage points, according to Kantar.

Meanwhile, over the same period, Android increased its share of sales in China by almost the same amount — gaining 3.4 percentage points to take a 76.4 per cent share of the market vs 73 per cent in the year ago period.

Android smartphone maker Huawei, which just yesterday unveiled a pair of new flagship smartphone co-branded with Leica, recaptured the top spot on the phone brand leader board, accounting for around a quarter (24.4 per cent) of phones sold in the region, according to Kantar’s sales data — just ahead of Apple’s 22.2 per cent.

Huawei has been bucking the trend of slowing global smartphone sales growth in recent quarters, with analyst Gartner noting the mobile maker grew 53 per cent in Q4 last year — its best year over year performance ever — outperforming rivals, including Samsung.

Other Chinese smartphone brands noted as performing well in the region by Kantar include Meizu and Oppo, which it said both showed “strong” year-on-year growth, capturing around 6 per cent of smartphone sales apiece.

Elsewhere, in Europe’s big five markets Android grew its share “steadily”, although performance varies considerably by market — with the OS, for example, taking a 90 per cent share in Spain vs a mere 55.5 per cent in the UK.

Join 10k+ tech and VC leaders for growth and connections at Disrupt 2025

Netflix, Box, a16z, ElevenLabs, Wayve, Hugging Face, Elad Gil, Vinod Khosla — just some of the 250+ heavy hitters leading 200+ sessions designed to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss the 20th anniversary of TechCrunch, and a chance to learn from the top voices in tech. Grab your ticket before doors open to save up to $444.

Join 10k+ tech and VC leaders for growth and connections at Disrupt 2025

Netflix, Box, a16z, ElevenLabs, Wayve, Hugging Face, Elad Gil, Vinod Khosla — just some of the 250+ heavy hitters leading 200+ sessions designed to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss a chance to learn from the top voices in tech. Grab your ticket before doors open to save up to $444.

Kantar notes that in the UK almost half (42 per cent) of the smartphone market falls in the premium category, while in Spain affordability is clearly the key driver for smartphone purchases — given Android near total dominance of the mobile landscape in the country.

Another tidbit from the data: the average selling price for smartphones in the US — where Android took a 58.9 per cent share — was $352. Kantar says that means around 69 per cent of Android buying consumers reported spending less than $350 on their device, vs some 39 per cent of iOS buyers.

It reckons those economics represent “a unique opportunity” for Apple’s newly launched smaller iPhone SE, given its $399 price point could appeal to more cost-conscious first-time smartphone buyers who might otherwise buy an Android smartphone. Or who are holding onto an old iPhone rather than upgrading. Albeit, time will tell how well the iPhone SE will sell.

The market watcher also reckons there are a “significant number” of potential buyers of Apple’s smallest iPhone in China, otherwise priced out of buying its flagship devices. And given iOS’ sales squeeze in the region over Chinese New Year, Cupertino will doubtless be hoping a downsized iPhone can fire up a regional growth engine again.