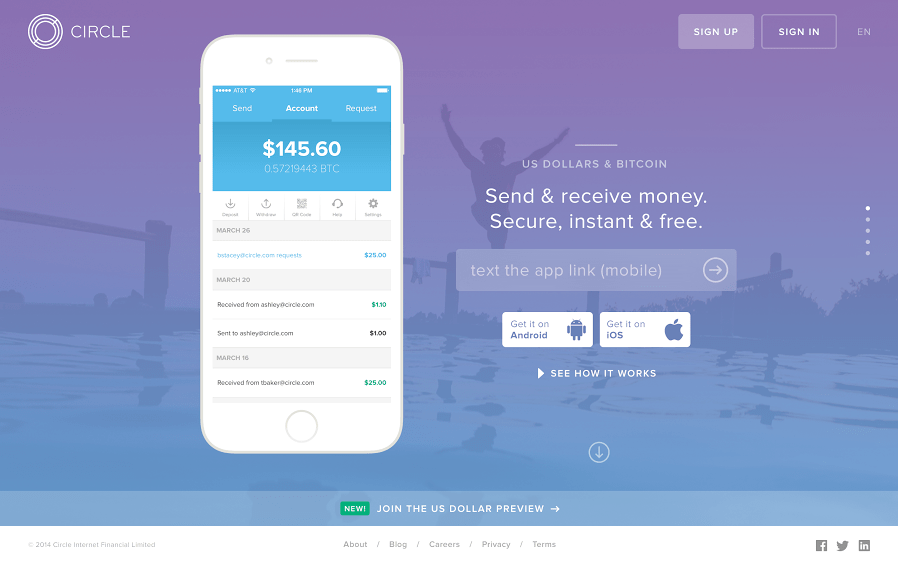

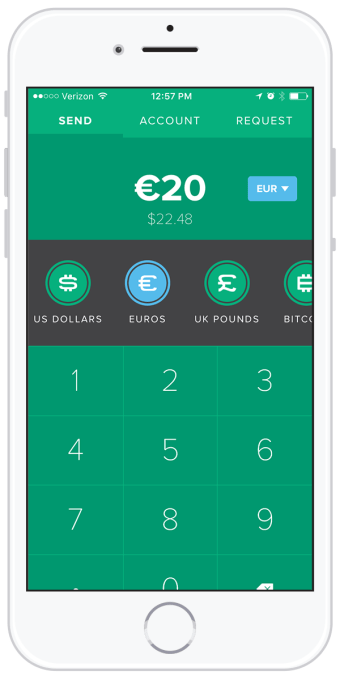

Circle has lit up two more European markets as it works to rapidly build out its presence in the region. Users of the P2P payments app in Spain and Ireland can now connect any Spanish or Irish bank account to the app to send and receive money within their own countries and across borders (with native Euro support in those markets).

As well as no fees for transfers, Circle touts having “the best exchange rate available to consumers” — saying its exchange rate is “typically” around 0.2 percent to 0.3 percent above the market rate versus 3-4 percent “typically” charged by banks (or the 1-2 percent typically charged by startups).

The U.S. P2P payments startup only rolled into Europe in April, when it launched for U.K. users — with sterling its second fiat currency after the dollar.

It’s also since taken in a $60 million funding round, and set up a separate China operation, called Circle China, with ambitions to help Chinese users send money overseas — which is another reason to expand its reach in Europe.

A spokesman said next on its priority launch list are large markets such as France, Italy, Germany, adding: “Others will fast follow.”

Notably, though, Circle is still not disclosing user metrics, more than a year after the U.S. beta launch of its payments app. And payments are a contested space, with many players offering services — from the likes of TransferWise’s feeless cross-border transfers to Facebook‘s push into social payments via its messaging app.

Join 10k+ tech and VC leaders for growth and connections at Disrupt 2025

Netflix, Box, a16z, ElevenLabs, Wayve, Hugging Face, Elad Gil, Vinod Khosla — just some of the 250+ heavy hitters leading 200+ sessions designed to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss the 20th anniversary of TechCrunch, and a chance to learn from the top voices in tech. Grab your ticket before doors open to save up to $444.

Join 10k+ tech and VC leaders for growth and connections at Disrupt 2025

Netflix, Box, a16z, ElevenLabs, Wayve, Hugging Face, Elad Gil, Vinod Khosla — just some of the 250+ heavy hitters leading 200+ sessions designed to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss a chance to learn from the top voices in tech. Grab your ticket before doors open to save up to $444.

Circle will only say that it’s “on pace” to do a billion dollars’ worth of volume transaction this year, and that user growth in the U.S. is 832 percent YTD, while the U.K. average quarterly growth rate is at 119 percent.

Prior to launching its Circle Pay app to try to grab a slice of the mobile social payments market, the startup had a bitcoin wallet. It now prefers to talk in terms of the power of blockchain technology, using bitcoin as a route to settle any cross-border payments into currencies where it does not yet have a local banking partner.