Xiaomi couldn’t have wished for better timing of two reports that claim it has toppled Samsung to become India’s top-selling smartphone company.

The Chinese firm, which is reportedly on a roadshow ahead of an IPO that could value it as high as $100 billion, is said to have beaten Samsung’s sales efforts in India, the world’s second-largest smartphone market behind China, according to new data from Canalys and Counterpoint.

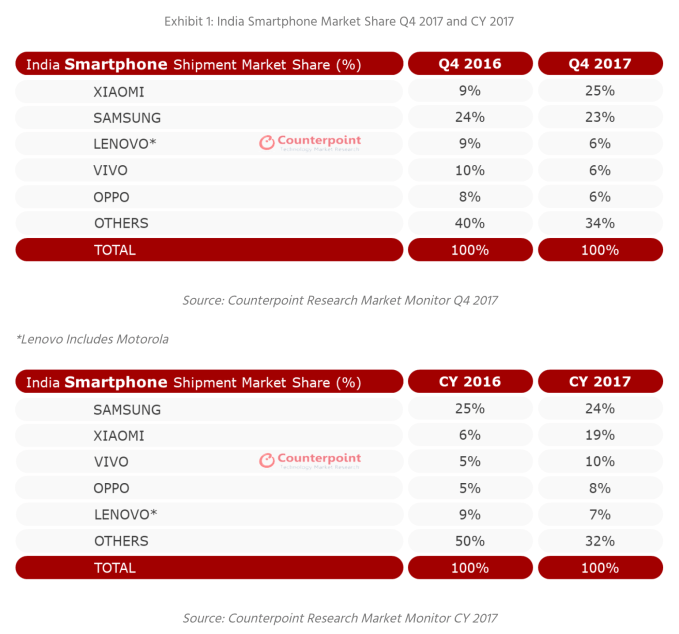

Data from both analyst houses gave Xiaomi a narrow lead over Samsung in the final quarter of 2017, with 27 percent and 25 percent, respectively, according to Canalys — and 25 percent versus 23 percent, according to Counterpoint.

Counterpoint included year-long figures, which conclude that Samsung (24 percent) is ahead of Xiaomi (19 percent) over the longer timeframe. A glance at the previous year’s figures shows that Xiaomi has closed what was once a significant gap with its rival.

It’s also striking just how dominant the pair are. Together they account for over half of all smartphones sales in India, which is quite something.

Counterpoint data

Join 10k+ tech and VC leaders for growth and connections at Disrupt 2025

Netflix, Box, a16z, ElevenLabs, Wayve, Hugging Face, Elad Gil, Vinod Khosla — just some of the 250+ heavy hitters leading 200+ sessions designed to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss the 20th anniversary of TechCrunch, and a chance to learn from the top voices in tech. Grab your ticket before doors open to save up to $444.

Join 10k+ tech and VC leaders for growth and connections at Disrupt 2025

Netflix, Box, a16z, ElevenLabs, Wayve, Hugging Face, Elad Gil, Vinod Khosla — just some of the 250+ heavy hitters leading 200+ sessions designed to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss a chance to learn from the top voices in tech. Grab your ticket before doors open to save up to $444.

Canalys’s Rushabh Doshi explained that Samsung lost ground because Xiaomi was able to exploit its weakness in the sub-INR15,000 (US$240) market with its affordable Redmi series.

Doshi pointed out, however, that Samsung’s “far superior” R&D and its supply chain expertise give it advantages that will help it compete fiercely with Xiaomi brand, which arguably better marketed in India.

That takeaway was echoed by Counterpoint Research, which pointed out that the $150-$240 price bracket is the fastest growing segment. Xiaomi, the firm estimates, accounted for some 37 percent of devices in this range that shipped to India.

With Xiaomi ramping up its offline sales in India, this is one battle to watch in 2018.

Canalys data