One day after announcing strong earnings and the massive strategic acquisition of the leader in yearbook and school photos, Shutterfly is watching its shares soar.

It’s quite a turn for a company that just over a year ago was staring at a massive new market competitor in Amazon, whose entry into the personalized photo-sharing market caused Shutterfly’s stock to tumble.

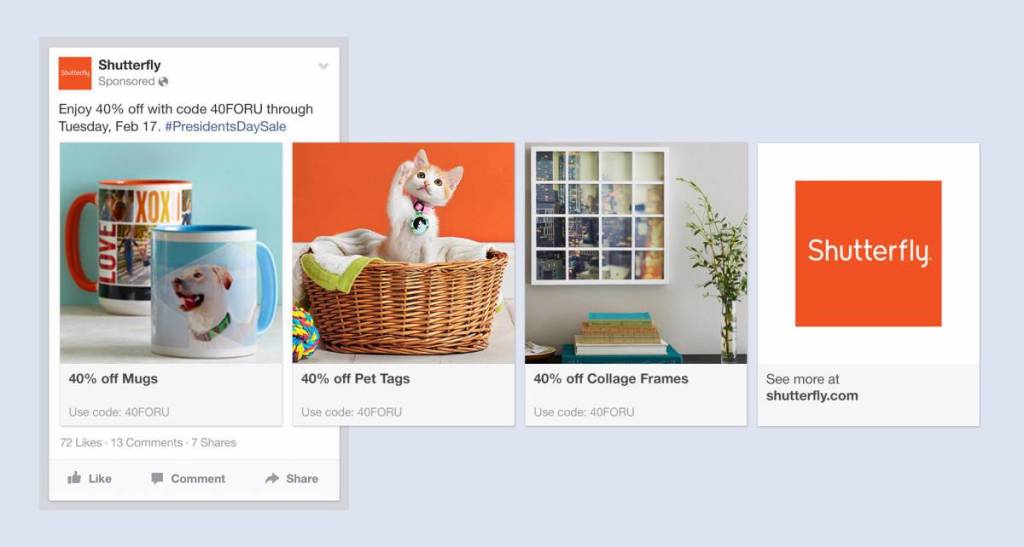

By buying Lifetouch for $825 million, Shutterfly not only gets the leading photo service for those adorably cute (or horrifyingly cute) school pictures that only a parent can love, it gets an opportunity to sell more crap that can now be customized with the faces of a parent’s darling little angel (or angels).

Lifetouch is responsible for taking the pictures of more than 25 million children a year during school picture time at the beginning of the year.

“It brings together two uniquely complementary assets, gives Shutterfly access to more than 10 million highly desirable households and, as a result, we expect to almost double our adjusted EBITDA by 2020,” said Shutterfly chief executive Christopher North, on yesterday’s earnings call.

On the strength of that deal, Shutterfly’s stock is buzzing. Its shares are on a victory lap run, rising $14.83 per share (or over 28 percent) in today’s trading to close at an all-time high.

Join 10k+ tech and VC leaders for growth and connections at Disrupt 2025

Netflix, Box, a16z, ElevenLabs, Wayve, Hugging Face, Elad Gil, Vinod Khosla — just some of the 250+ heavy hitters leading 200+ sessions designed to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss the 20th anniversary of TechCrunch, and a chance to learn from the top voices in tech. Grab your ticket before doors open to save up to $444.

Join 10k+ tech and VC leaders for growth and connections at Disrupt 2025

Netflix, Box, a16z, ElevenLabs, Wayve, Hugging Face, Elad Gil, Vinod Khosla — just some of the 250+ heavy hitters leading 200+ sessions designed to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss a chance to learn from the top voices in tech. Grab your ticket before doors open to save up to $444.

The acquisition wasn’t the only bit of good news for Shutterfly or its shareholders. The company also blew past the earnings targets analysts had set for the company. Analysts had estimated earnings per share of roughly $2.88, and Shutterfly clocked in with $3.11 earnings per share.

“We had a very successful fourth quarter with net revenues of $593.8 million, with strong performance in both consumer and SBS,” North said yesterday. “We also performed well on adjusted EBITDA, with the fourth quarter coming in at $215.6 million.”

The Lifetouch acquisition also should help smooth lumpy revenues for the company extending its highest trafficked months to another season with the addition of a massive business in fall portraiture.

Just look at Lifetouch’s numbers. The company posted nearly $1 billion in sales for the year ended June 30, according to Lifetouch. Shutterfly said that it expects the new business to generate $450 million of adjusted earnings before interest, taxes, depreciation and amortization by 2020.

“In 2018, we will accelerate the pace at which we expand the range of products we offer. I’m excited to share that we will be launching two new categories this year, kids and pets, clearly a natural fit for our customer base,” North said on the earnings call. “Both new categories will launch in the third quarter and we will provide more details closer to the launch date. We’ll also continue to add to the personalized gifts and home décor range. Overall we will be doubling the number of new products launched in 2018 versus 2017.”