Menlo Ventures, the 43-year-old venture firm with offices in Menlo Park and San Francisco, is currently investing a $450 million fund to invest primarily in early-stage consumer, enterprise and frontier technologies that it closed in 2017.

Now, it has a $500 million later-stage fund, too, the firm is announcing this morning.

Dubbed its “inflection” fund, the fund looks like the second opportunities-type fund for the firm, which had closed its first later-stage effort with $250 million in 2016. That said, its mandate appears broader than to simply back Menlo’s own breakout portfolio companies. Instead, the fund will be investing between $20 million and $40 million in any promising companies that are seeing at least $5 million in annual recurring revenue, growth of 100 percent year over year, early signs of retention and are operating in areas like cloud infrastructure, fintech, marketplaces, mobility and SaaS (and targeting both consumers and enterprises).

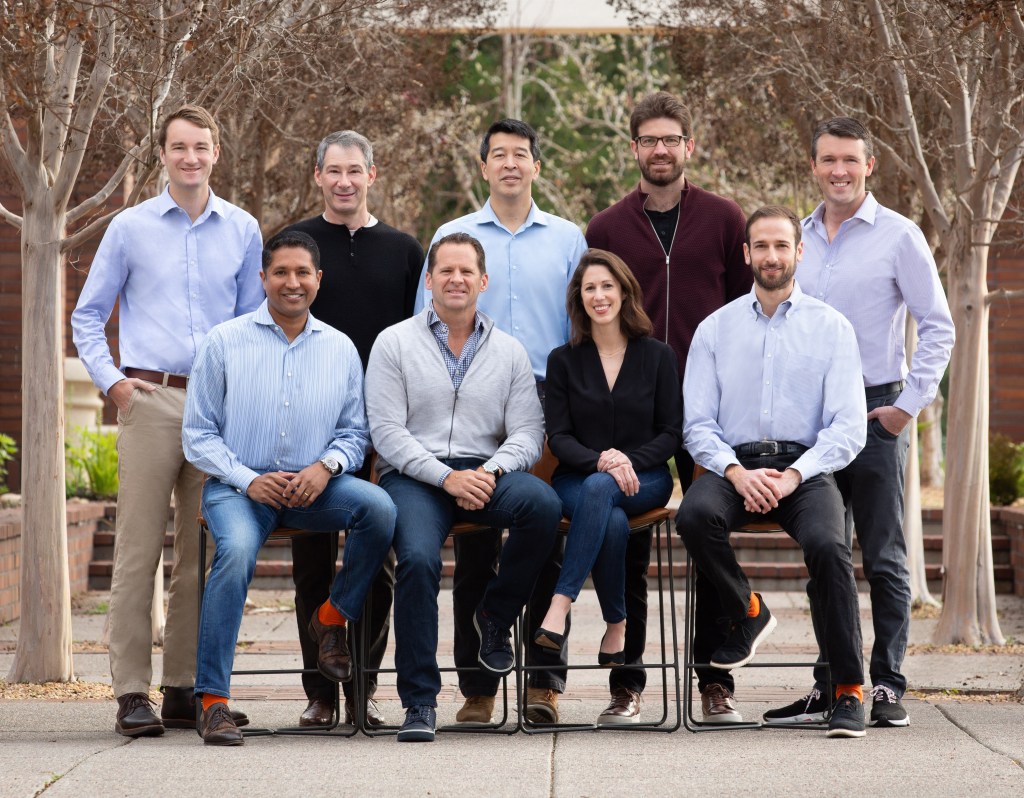

The new fund is being led by partners Mark Siegel, Matt Murphy, Shawn Carolan, Tyler Sosin and Venky Ganesan, and joined by Steve Sloane, whose recent promotion makes him the youngest partner in Menlo’s history.

Of course, in 2019, it’s hard not to notice that the partners really put the “men” in Menlo, though there is some, small movement toward greater gender parity at the firm. Specifically, last year, the firm brought aboard Naomi Pilosof Ionita as an investing partner focused on early-stage consumer deals. She’d previously been the VP of Growth at the invoicing and expenses app Invoice2go, and prior to that, a product lead at Evernote.

In the meantime, it’s probably safe to assume that Menlo had little problem raising the vehicle, given it has returned a bunch of money to its limited partners in the last 15 months: $2.4 billion says the firm.

According to our sources, that money that came via Uber’s secondary sale to SoftBank (Menlo had led Uber’s Series B round), the IPOs of both the streaming device company Roku and laser manufacturer nLight, and the $1 billionish acquisition by Amazon of the online pharmacy PillPack.

Join 10k+ tech and VC leaders for growth and connections at Disrupt 2025

Netflix, Box, a16z, ElevenLabs, Wayve, Hugging Face, Elad Gil, Vinod Khosla — just some of the 250+ heavy hitters leading 200+ sessions designed to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss the 20th anniversary of TechCrunch, and a chance to learn from the top voices in tech. Grab your ticket before doors open to save up to $444.

Join 10k+ tech and VC leaders for growth and connections at Disrupt 2025

Netflix, Box, a16z, ElevenLabs, Wayve, Hugging Face, Elad Gil, Vinod Khosla — just some of the 250+ heavy hitters leading 200+ sessions designed to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss a chance to learn from the top voices in tech. Grab your ticket before doors open to save up to $444.

Another Menlo-backed company, Eero, a home mesh router startup, was acquired by Amazon last week. Terms were not disclosed.

Pictured above: Menlo Ventures’s investment team, across both its early and later-stage funds.