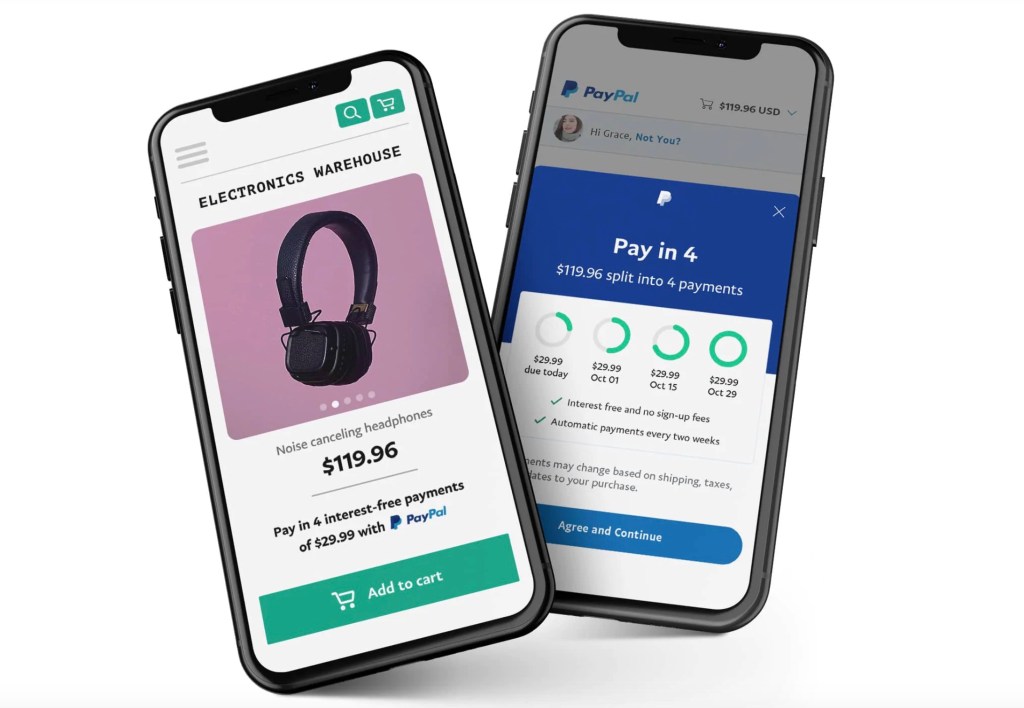

PayPal today introduced a new installment credit option for PayPal users called “Pay in 4.” The name itself explains what the service offers — basically, it’s the ability for customers to pay for purchases, interest-free, over four separate payments. The service is an expansion on PayPal’s existing lineup of Pay Later solutions, which also includes PayPal Credit’s revolving credit line and its Easy Payments.

With Pay in 4, customers can choose to pay for purchases between $30 and $600 over a six-week period. Because it’s included with the merchant’s existing PayPal pricing, they won’t have to pay more fees to offer the option to their customers — as they do with several competitive “buy now, pay later” services.

For customers, the short-term payment option allows U.S. customers to pay for a purchase over time, without fees or interest. After their initial payment, the remaining three payments are automated. The feature will also appear in the customer’s PayPal wallet, where the payments can be managed.

Pay in 4 builds on PayPal’s tests with Easy Payments. The company says it learned that, at some price points, customers preferred the option to pay over a six-week period.

The service clearly is meant to compete with rival fintech services like Klarna, AfterPay, Affirm and others, which may or may not charge fees or interest up front, but do often tack on late fees when consumers can’t pay. Klarna, for example, even offers a direct competitor with its program offering four interest-free payments charged to your card every two weeks.

Because PayPal is tied to a customer’s payment card or bank account, it reduces the chance of a forgotten payment. But if the customer can’t pay, there will be fees involved. These will vary by state, as each state has its own late fee structure which PayPal will abide by, the company says.

“In today’s challenging retail and economic environment, merchants are looking for trusted ways to help drive average order values and conversion, without taking on additional costs. At the same time, consumers are looking for more flexible and responsible ways to pay, especially online,” said Doug Bland, SVP, Global Credit at PayPal, in a statement about the launch. “With Pay in 4, we’re building on our history as the originator in the buy now, pay later space, coupled with PayPal’s trust and ubiquity, to enable a responsible and flexible way for consumers to shop while providing merchants with a tool that helps drive sales, loyalty and customer choice,” he added.