Box reported fiscal Q2 2023 revenue of $246 million last week, up 15% from its year-ago result. While that pace was down slightly from the 18% growth Box posted in its prior quarter, the rate of expansion appears to be what the company fancies in terms of growth moving forward.

That $246 million figure puts the company on a run rate of nearly $1 billion, a magic milestone for any SaaS company. What’s more, the company’s guidance for the current quarter of between $250 million and $252 million puts it over the top in terms of reaching a 10-figure run rate.

By now, it’s well-known that Box has not had an easy time in the public markets. To get to today, it had to survive the slings and arrows of an activist investor, to pick an example, something that it has now come out the other side of.

And in better shape than you might have guessed. Consider fellow SaaS companies Zoom and Dropbox as comparison points. Both companies reported revenue growth of around 8% in their most recent earnings report, just over half of what Box detailed.

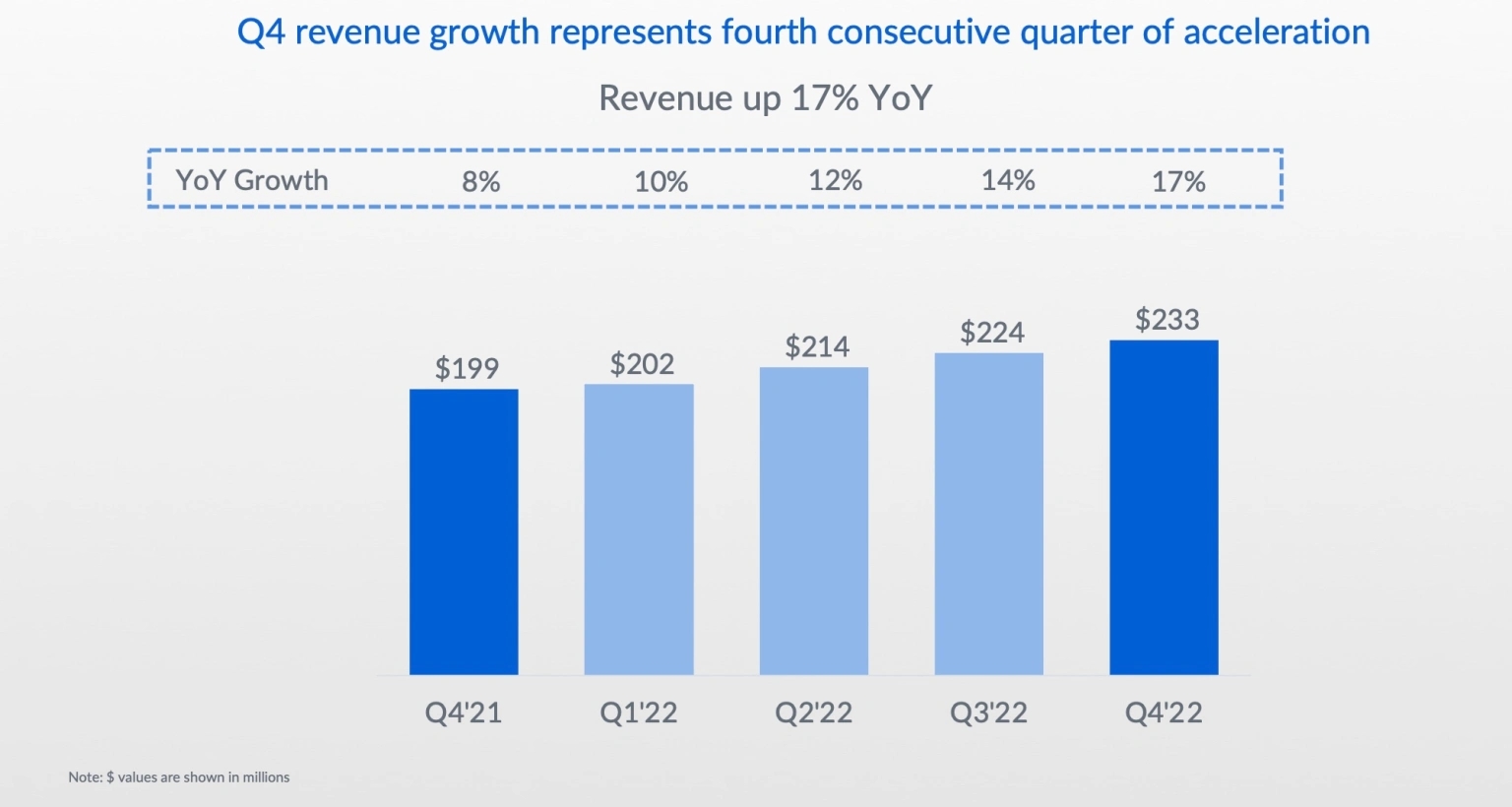

Lest we forget, Box was stuck at a similar 8% growth in Q4 of its fiscal 2021, about the same time that Starboard Value began its pressure campaign on the company.

Box was able to grow steadily, as the chart below from the Q4 2022 investor presentation illustrates:

Also consider that Zoom stock is down 56% year to date, while Dropbox is down 13%. Box stock, meanwhile, was up a hair heading into today’s trading, pushing into -1% territory on the year thus far.

Join 10k+ tech and VC leaders for growth and connections at Disrupt 2025

Netflix, Box, a16z, ElevenLabs, Wayve, Hugging Face, Elad Gil, Vinod Khosla — just some of the 250+ heavy hitters leading 200+ sessions designed to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss the 20th anniversary of TechCrunch, and a chance to learn from the top voices in tech. Grab your ticket before doors open to save up to $444.

Join 10k+ tech and VC leaders for growth and connections at Disrupt 2025

Netflix, Box, a16z, ElevenLabs, Wayve, Hugging Face, Elad Gil, Vinod Khosla — just some of the 250+ heavy hitters leading 200+ sessions designed to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss a chance to learn from the top voices in tech. Grab your ticket before doors open to save up to $444.

How did we get here? To a place where the formerly beleaguered Box is outgrowing a pandemic darling? The company has settled on a strategy of putting content at the center of the workplace, building a platform of integrated tools to help companies store, secure, govern and work on documents. It’s a plan that seems tailor-made for an increasingly digital world, but being in the right place at the right time is no guarantee of success in the current climate.

What is Box doing to push its revenue numbers? And how does it plan a future of both growth and making money now that the market appears to demand both? We spoke to CEO and co-founder Aaron Levie to understand the company’s strategy moving forward.

Box strategy comes into focus

From its earliest days when it targeted Microsoft SharePoint, Box has worked to push content management to the cloud. Over time, its service mix has expanded from storage and collaboration to governance, security and other pieces of its present-day platform, like the e-signature capability added when it bought SignRequest in 2021.

Analyst Alan Pelz-Sharpe, who has covered the content management market for years, sees Box emerging stronger after a couple of tough years. “Truth is Box has become sticky, easy to use and relied upon by many large organizations. In short, it has matured,” he said.

He added that Microsoft remains a primary competitor but with some additions to the platform, Box can go toe-to-toe with Redmond.

“Moving forward, Box has an opportunity to grow much further but will likely need to add more automation and AI and IDP (intelligent document processing) to its stack, as Microsoft, its closest competitor (in particular Microsoft Syntex), is now starting to make a market impact beyond traditional SharePoint,” he said.

Box sees a growing body of content out there — fueled by digital transformation, naturally — and believes it’s in a good place to help manage that, especially as more work shifts to the cloud in an increasingly hybrid world. Levie offers video content as an example.

“All of a sudden, when our meetings go virtual, we now have more and more of this content exhaust being created in the form of video or audio,” he said. “And that wasn’t a meaningful contributor to our dataset a decade ago because the only people that were really doing video were just people in the media industry or marketing teams. But now when every meeting gets digitized, we have so much more video content than ever before,” Levie told TechCrunch.

He sees a world where hybrid work is becoming central to how we operate, meaning a continued shift toward digital content that needs to be managed.

“That means that all of our work has to be mediated by digital platforms. And ultimately, that’s going to create more and more content that we’re going to want to share, secure, manage, govern, automate workflows around, get digitally signed [and so forth]. So there’s more opportunity than ever before around the creation and use of new forms of content.”

While Levie feels the build-versus-buy tension, and the company has done some tuck-in pieces like SignRequest in the past, his preference is building if possible, as Box did with Canvas, a whiteboarding tool announced in the spring with a fall release expected.

“We will generally be biased toward building. But if there’s a market that we think is incredibly meaningful, where there’s a discrete piece of technology that will let us get into that space faster, and we can integrate it, [we will acquire it],” he said.

Growth, profit

The build-versus-buy conversation is not incidental to the key question that Box has answered with its recent growth re-acceleration. Namely, how the company will continue to attract new customers in a competitive landscape.

Box has to toe a line between growing quickly enough to satisfy Wall Street while also ensuring that its profitability remains in the zone that investors expect from software companies past their startup-growth days. (Buying another company, naturally, could be a way to tack on revenues without a long wind-up of hiring to build a new service ahead of its anticipated top line.)

The company expresses this tension with a sort of “Rule of 40” measurement. Box combines its revenue growth with its free cash flow (FCF) margin in its reporting to show progress in balancing faster growth and making money. For example, in its fiscal 2020, Box had a combined revenue growth and FCF rate of 13%. That grew to 26% and 33%, respectively, in its fiscal 2021 and 2022. Now in the second quarter of its fiscal 2023, Box anticipates a 37% combined result. (For its fiscal 2025, it’s 43% to 44%.)

So how is the company balancing the two moving forward? We asked Levie that, framing the question as a tradeoff between growth and near-term net income. Here’s his response, lightly condensed for readability:

“The target model is growth in the sort of mid- to high-teen percentage area,” Levie said. “And then operating margin gets into the mid- to high 20s. That’s the rough composite sketch of how we think about it. And we think that growing at these or higher rates on a sustained basis will be very valuable for investors.”

Is that enough growth? The CEO thinks so, saying that “on a compounded basis,” Box’s anticipated growth “looks very strong.”

How does Box boost profitability while holding its growth rate around where it is today? It turns out that the company is of a scale where operating leverage is now built into its work.

“Higher operating margin comes with the territory of our scale,” Levie explained. “Where we can drive efficiency in the business, we get more leverage as we scale up. Most parts of the business at this point, as they grow, they inherently get more efficient because of the economies of our scale.”

So for Box, the tradeoff today isn’t growth versus profitability. Instead, it can hold growth steady and let operating leverage accrete bottom-line expansion. Sure, Box could grow faster if it decided to go out and use some of its equity to buy another company — Box still had $29 million in its share buyback program at the end of its July 31, 2022, quarter, mind, and has friends helping with the effort — but it likely doesn’t need to do that to reach its stated goals.

That’s the power of a software business at scale, meaning that Box is now a target not merely for startups that want to ape its path to nine-figure private rounds, a founder-CEO and public-company status. It also managed to pull off the growth-for-profitability swap that so many companies struggle with. That makes it actually perhaps more attention-worthy for startup founders today than at any point since its IPO.