Welcome back to This Week in Apps, the weekly TechCrunch series that recaps the latest in mobile OS news, mobile applications and the overall app economy.

The app economy in 2023 hit a few snags, as consumer spending last year dropped for the first time by 2% to $167 billion, according to the latest “State of Mobile” report by data.ai (previously App Annie). However, downloads are continuing to grow, up 11% year-over-year in 2022 to reach 255 billion. Consumers are also spending more time using mobile apps than ever before. On Android devices alone, hours spent in 2022 grew 9%, reaching 4.1 trillion.

This Week in Apps offers a way to keep up with this fast-moving industry in one place with the latest from the world of apps, including news, updates, startup fundings, mergers and acquisitions, and much more.

Do you want This Week in Apps in your inbox every Saturday? Sign up here: techcrunch.com/newsletters

Top Stories

State of Mobile 2023 arrives, consumer spending slows

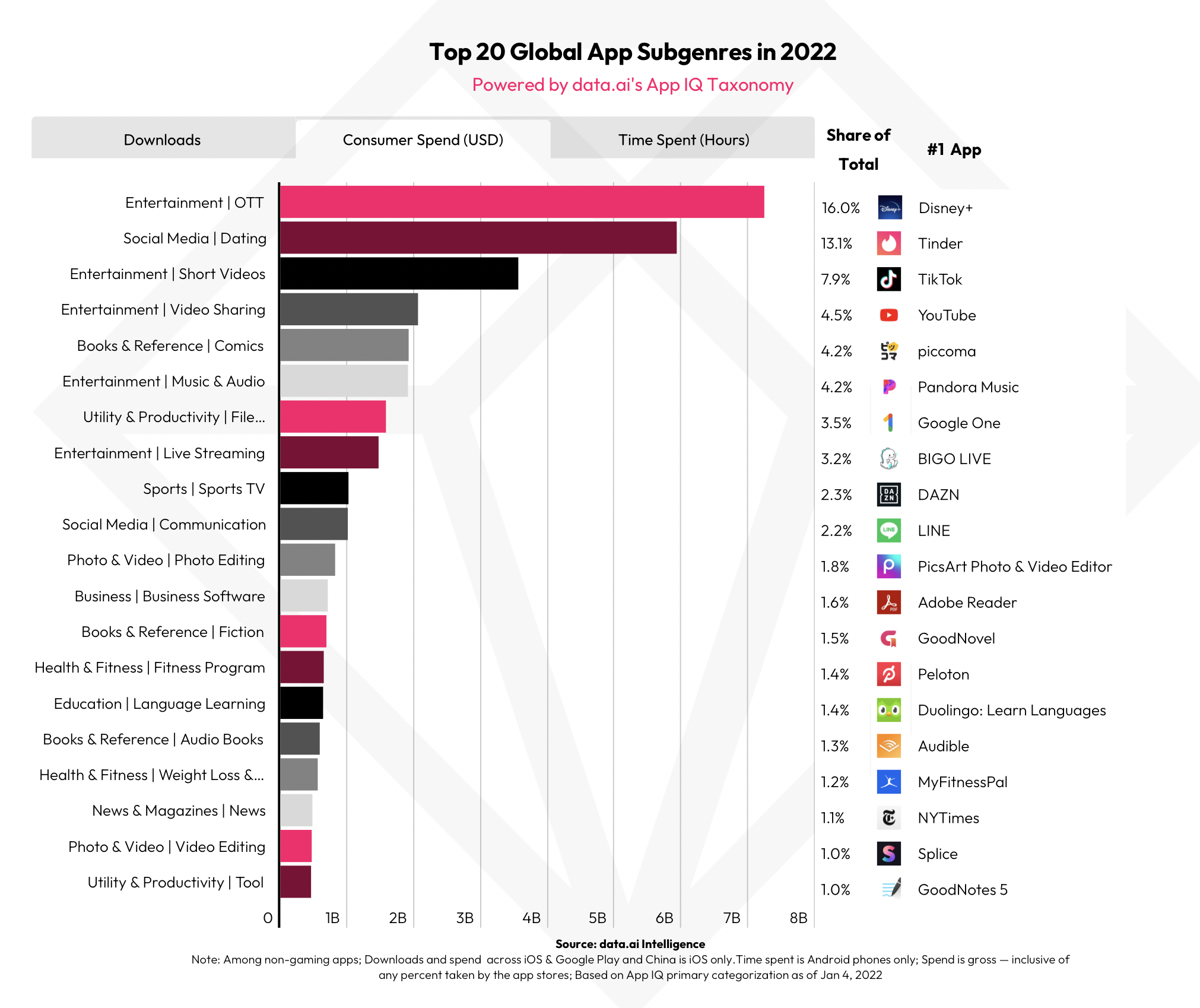

Data.ai’s anticipated review of the app ecosystem, “State of Mobile 2023,” arrived this week, finding that consumer spending on apps has been hit by the same macroeconomic forces impacting the broader economy. That led to a first-time drop in consumer spending after years of record growth. However, there are some bright spots in the report’s findings. For starters, it seems that non-game apps are more resilient than games in a down economy. Though consumer spend on mobile games dropped 5% to $110 billion, spending on non-game apps increased 6% to $58 billion — driven by streaming subscriptions, dating apps and short-form video apps.

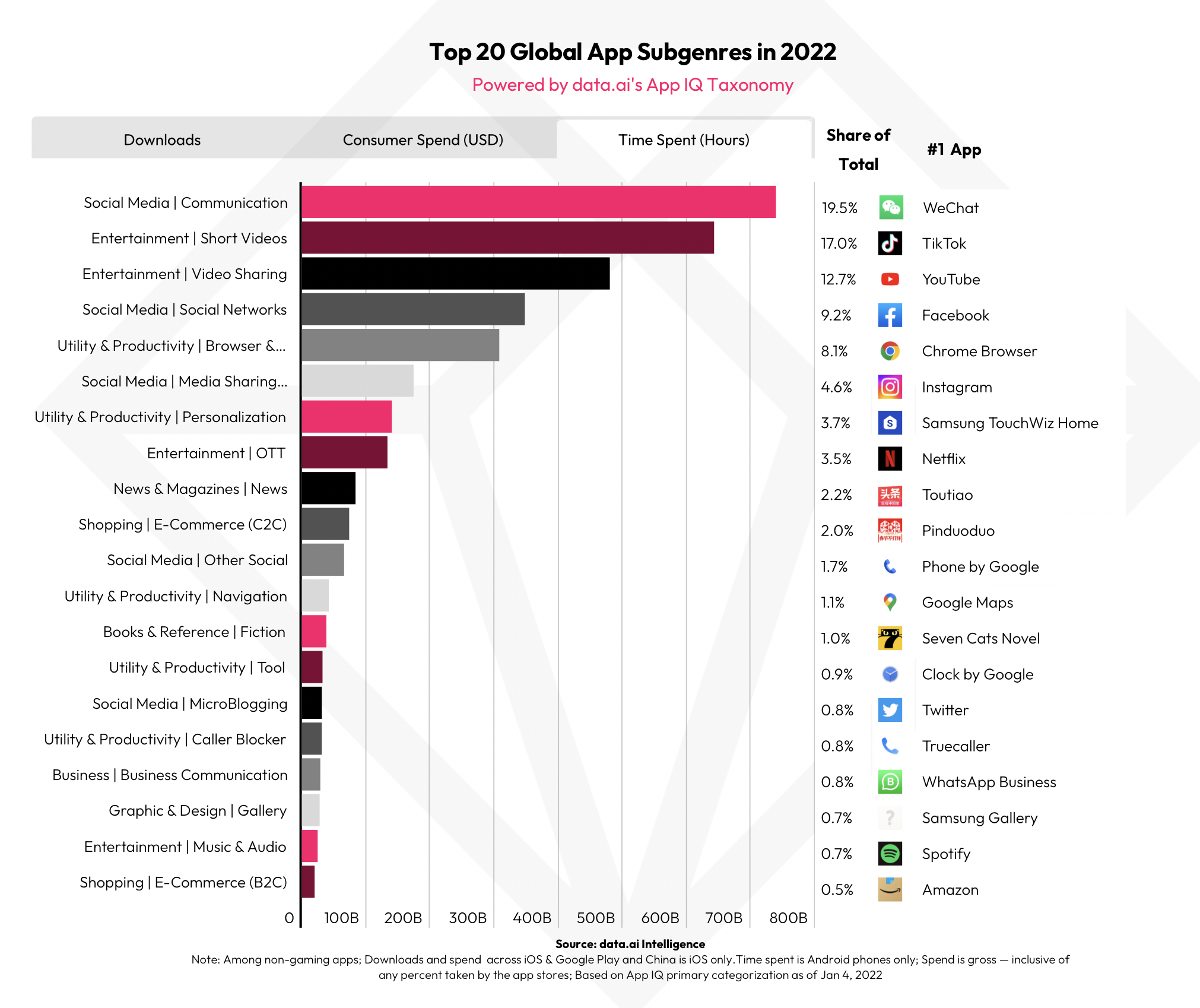

The data also indicated that despite the tightening of wallets, consumer engagement on mobile continues to grow. Across top mobile markets, consumers were spending 5 hours, 2 minutes per day in 2022 using their apps, up 9% from 2020. That’s remarkable, given that 2020 was the onset of the COVID pandemic, which tied everyone to their phone and rapidly changed consumer behavior. However, there is a caveat to this news: Much of mobile users’ time is monopolized by three app categories, which accounted for half the time spent on mobile: Social Media/Communication (19.5% of total time); Entertainment/Short Video (17% of total time); and Entertainment/Video Sharing (12.7% of total time).

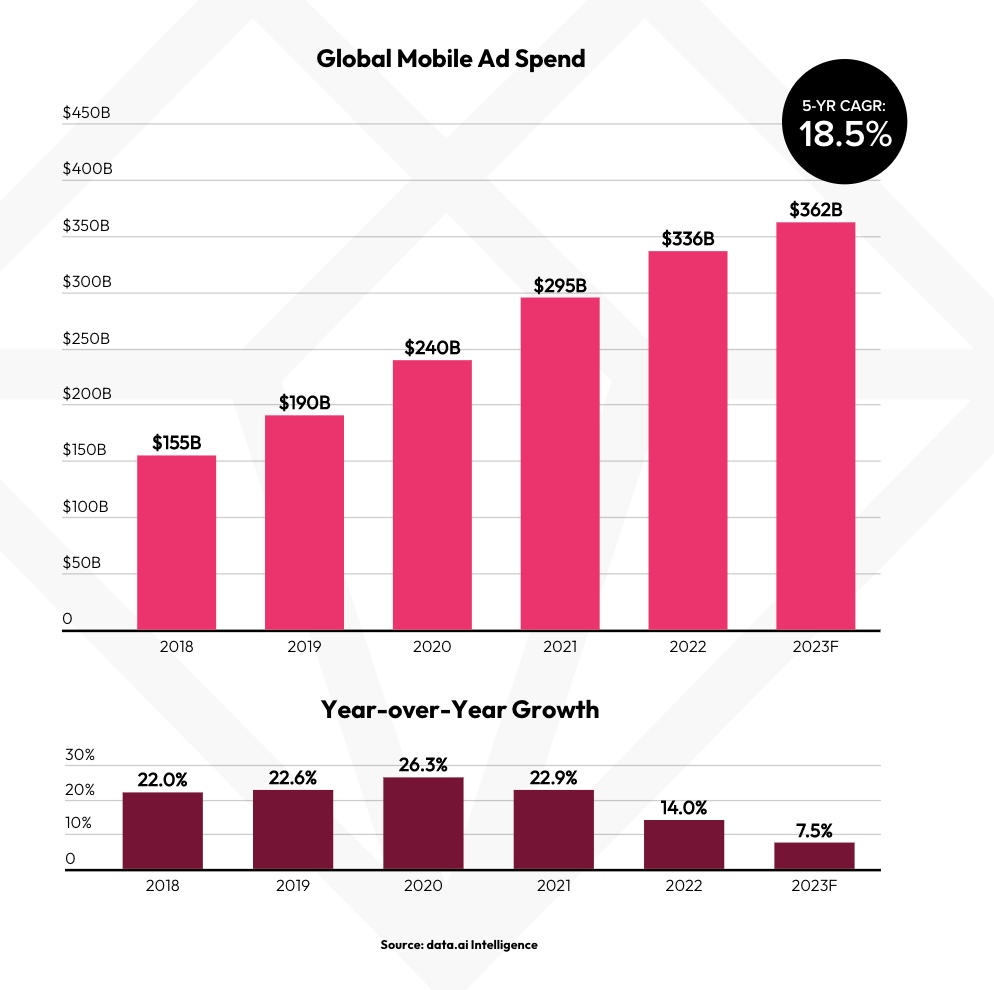

In addition, while mobile ad spend growth will also slow alongside the economy, it will not decline. Data.ai is forecasting that mobile ad spend in 2023 will hit $262 billion, up from $336 billion this year as short video apps drive growth. TikTok, for example, became the second-ever non-game app to top $6 billion in all-time consumer spending, the report noted.

Join 10k+ tech and VC leaders for growth and connections at Disrupt 2025

Netflix, Box, a16z, ElevenLabs, Wayve, Hugging Face, Elad Gil, Vinod Khosla — just some of the 250+ heavy hitters leading 200+ sessions designed to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss the 20th anniversary of TechCrunch, and a chance to learn from the top voices in tech. Grab your ticket before doors open to save up to $444.

Join 10k+ tech and VC leaders for growth and connections at Disrupt 2025

Netflix, Box, a16z, ElevenLabs, Wayve, Hugging Face, Elad Gil, Vinod Khosla — just some of the 250+ heavy hitters leading 200+ sessions designed to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss a chance to learn from the top voices in tech. Grab your ticket before doors open to save up to $444.

The first category — Social Media/Communication — includes WeChat, WhatsApp, Facebook, Messenger, Telegram, LINE and Discord, while the Entertainment and Short Video category is where you’ll find TikTok as well as Kwai, Vido Video, Baidu Haokan and Snack Video. The last category of Entertainment and Video Sharing includes long-form video like YouTube, YouTube Kids and bilibili.

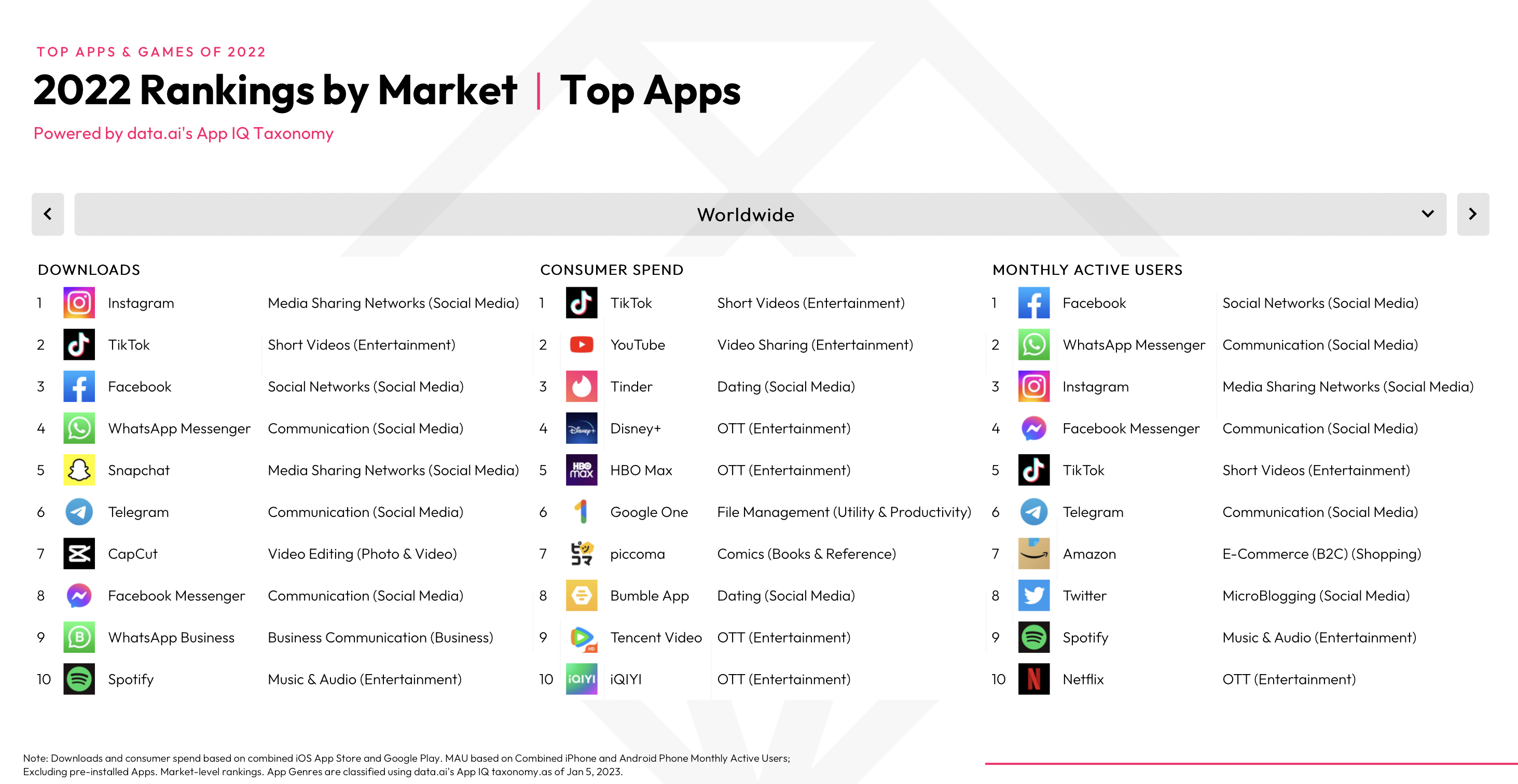

One finding that jumped out at me is that TikTok this year lost its No. 1 position on the Top Charts by Downloads to Instagram, the Meta-owned social app that has been desperately trying to clone TikTok’s feature set with Reels. Data.ai’s report indicated that Meta had a bit of a comeback this year, with Instagram bumping TikTok on downloads, though TikTok remained No. 1 by consumer spending. However, in terms of real-world use, TikTok is much further down the charts.

In 2022, the top four non-game apps by monthly active users were all owned by Facebook. In order, they were Facebook, WhatsApp Messenger, Instagram, then Facebook Messenger. TikTok was No. 5. Amazon, which was No. 5 last year, slipped to No. 7 while Telegram moved up to No. 6 from No. 7 in 2021. Twitter, Spotify and Netflix rounded out the charts.

The report delves into other interesting trends related to specific categories of apps (some of which we may get into later), but one particular area of interest to us involved the detailed habits of Gen Z consumers. Unlike the top apps used by older generations, which tend to be more utilitarian and practical (think Amazon, eBay, Walmart, The Weather Channel, Waze, Ring, PayPal and others), Gen Z is still devoted to video apps, user-generated content and mindfulness apps, data.ai said. (Ah, youth!) They also have a preference for Meta’s Instagram over Facebook, TikTok, Snapchat, Netflix and Spotify.

Another trend driven by younger users was the rise of BeReal, a more authentic photo-sharing app that prompts users once a day to take candid photos of themselves and what they’re doing. Data.ai found that no other social app added more new users in the U.S. over the past five years than the 5.3 million users BeReal gained in August 2022. But the firm suggested BeReal may struggle to grow engagement since the app only asks people to use it for brief periods. However, in speaking with those close to the company, we understand BeReal is purposefully trying to build a non-addictive social app — it just doesn’t know how to monetize that sort of creation.

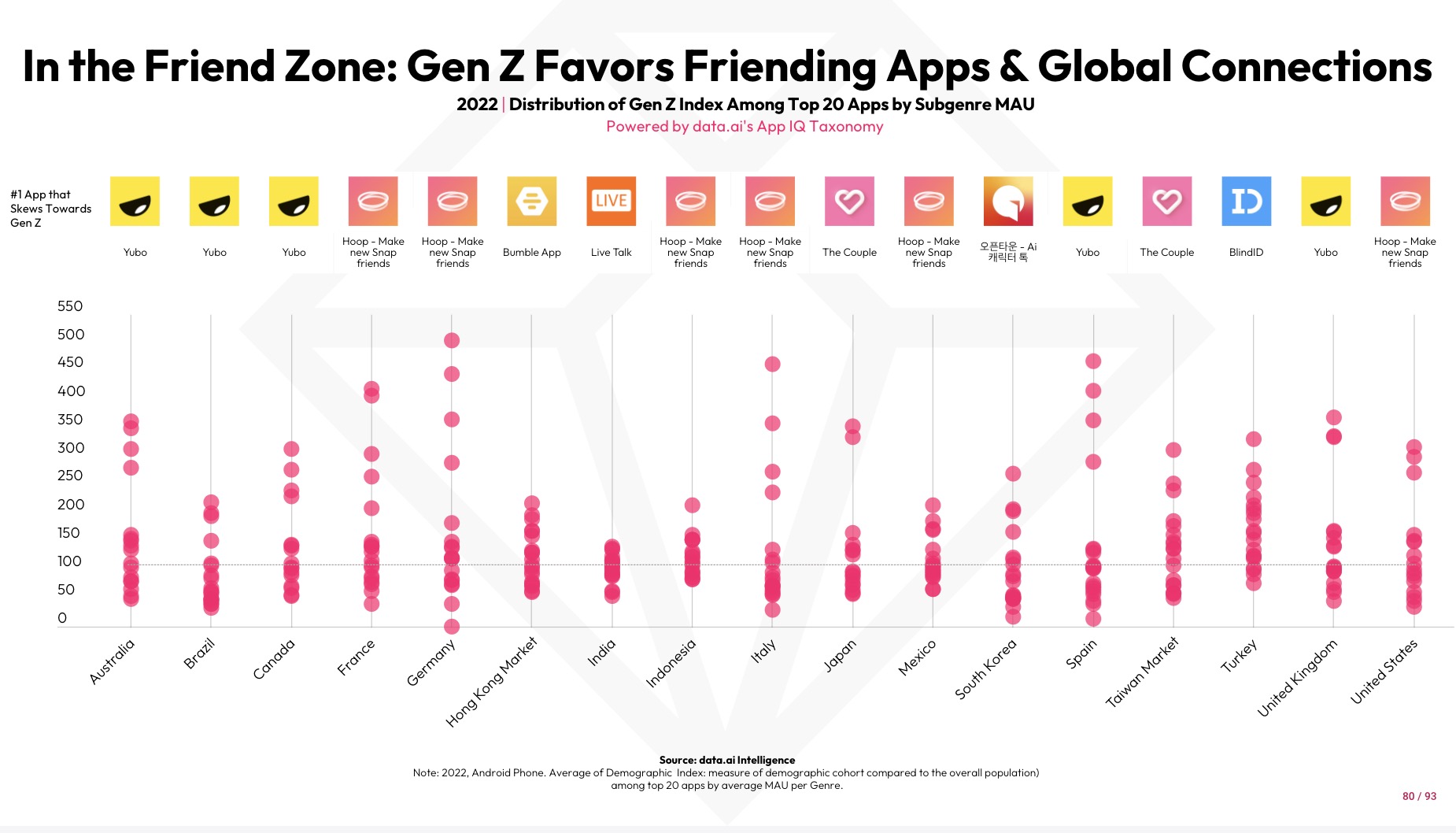

Another app category driven by Gen Z trends is friend-finding, which includes apps like Yubo, Hoop, Bumble (for its BFF feature), Live Talk and others.

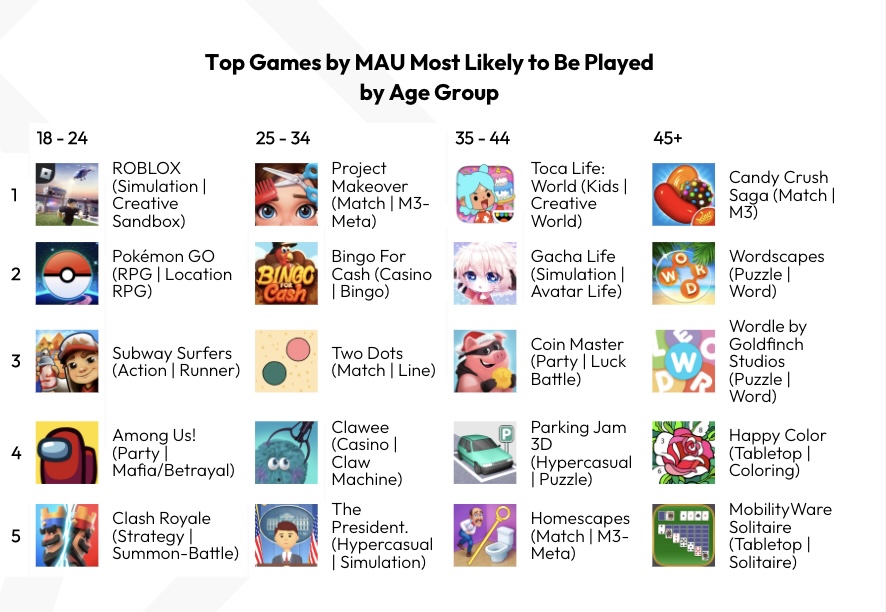

Meanwhile, in terms of gaming, the Gen Z demographic showed a preference for party, simulation and shooters, and counted Roblox as their No. 1 app. If there’s any wonder why Meta is spending billions trying to develop a virtual gaming landscape with Horizon Worlds, just look at Roblox’s growth and traction among the younger demographic. “Creative Sandbox” games like Roblox as well as Minecraft saw a global increase in time spent last year, up 25% from 2021 to 2022.

A few other interesting highlights:

- The most-searched iOS App Store keywords in the U.S. for entertainment apps were, in order: netflix, disney+, hulu, HBO max, paramount, paramount+, amazon prime, peacock tv, prime video and tubi. Maybe Netflix will be okay after all.

- Genshin Impact reached $3 billion in in-app purchases in Q2 2022.

- Game publishers in China drove a third of consumer game spending.

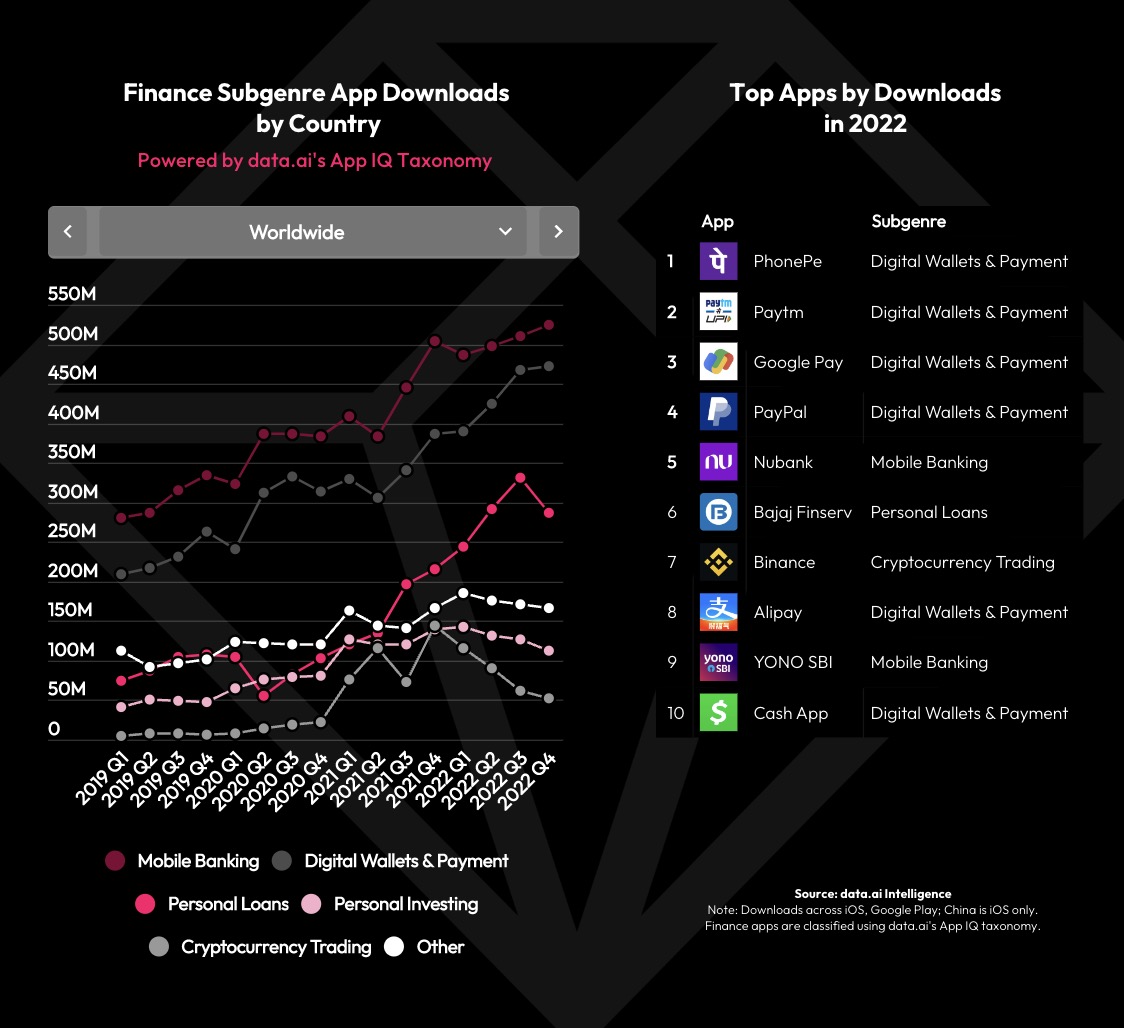

- Crypto apps’ downloads fell in 2022, even as other fintechs grew.

- Average MAUs among the top five neobanks in the U.S. climbed from 1.4 million in 2020 to 2.2 million in 2022. Chime is the market leader in both active users and user engagement.

- Consumers spent nearly 110 billion hours in shopping apps in 2022, up 9% globally. Cost-conscious shoppers drove growth.

- Total time spent in social apps climbed 17% year-over-year to over 2 trillion hours on Android phones in 2022. The U.S. accounted for more than one-fourth of social app consumer spending.

- Sports betting app downloads hit 4.3 million at the start of the 2022-2023 NFL season, up 8% year-over-year from 2021.

- Language learning apps saw 31% year-over-year growth as travel returned post-pandemic.

- Consumer spend in dating apps grew 12% year-over-year in 2022, and 91% year-over-year compared to pre-pandemic spend.

Apple let scammy “ChatGPT” apps flood the App Store

What, no I mean, what is going on with App Review? For years, Apple has been caught off guard at times, allowing violative apps to slip through its review process to be published on the App Store until users or the media called out the mistake.

But in the case of the scam “ChatGPT” apps that flooded the App Store over the past couple of weeks, one has to wonder if Apple is even paying attention at all. ChatGPT’s maker OpenAI doesn’t offer a public API, so that should have been a red flag to reviewers about any app claiming a ChatGPT or OpenAI connection in its name or description, then charging money for access. One app, called “ChatGPT Chat GPT AI With GPT-3,” even managed to reach the Top Charts in the productivity category in multiple countries as a result of consumer demand for ChatGPT and Apple’s inattention. (The app was removed shortly after reporters, including ourselves, reached out to Apple for comment. Apple never answered our emails.)

The iOS App Store is full of folks putting ChatGPT into a paid wrapper with ambiguous language that would let you believe you’re paying for ChatGPT pic.twitter.com/3w0rK14E5I

— Austen Allred (@Austen) January 7, 2023

Google Play had the same problem, but frankly, consumers expect more from Apple’s App Store. In fact, Apple’s argument against antitrust concerns, like its ban on sideloading and third-party app stores, has to do with the safety and security of its users. Apple says only it should be trusted to keep consumers safe. But surely that means Apple should also be protecting consumers from scam apps and subscription scams. But it is not.

And while no system is perfect, it seems like the apps that are at the top of the App Store’s charts — or those that quickly moved up the charts for unknown reasons — should go under an additional review by Apple, just to make sure they’re playing by the rules. Developers have long argued that Apple should be cracking down on apps with high-priced subscriptions or those that are charging users for basic utilities or otherwise free features — in other words, the apps that are profiting from scamming users. If it did so, a subscription-based app that appeared to be charging for access to a free service with a non-public API wouldn’t have made the cut.

These things aren’t hard to spot either — third-party app intelligence services can parse customer reviews for negative sentiments and keywords, so surely Apple could implement a system of its own, if it wanted to. In the case of the scammy ChatGPT apps, customer reviews called the apps fake and non-functional, warning others not to get scammed. Where was Apple on this issue? Until the media coverage, it was quietly collecting its cut of the scammers’ subscription revenues.

In other App Store news, activist investors have pressured Apple for more insight into app removals, the FT reported, but their interest lies in wanting a better understanding of when Apple acquiesces to foreign governments’ requests. The company will begin including additional information in its Transparency Report about whether removals are related to local laws and how many apps were pulled in each country.

Goodbye, Instagram Shop. Move over, Reels.

Instagram announced this week it will simplify its in-app navigation after years of confusing changes designed to push various products like Instagram Shop and Reels. The company said, starting in February, it will return the Compose button (the plus sign “+”) to the front and center of the navigation bar at the bottom of the app and it will remove the Shop tab entirely.

As a result, the Reels button will now move over to the right of Compose, losing its prime spot.

The earlier changes that had pushed Reels over Compose had been fairly controversial as Instagram users felt as if the company was forcing them to use the app’s new products at the expense of the overall user experience. Instagram defended the changes in prior years as a way to introduce users to its new products. But in more recent months, there’s been increased backlash over how far Instagram has deviated from its original mission. Even the Kardashians criticized the app for “trying to be TikTok.”

Instagram said shopping on Instagram will continue to be supported despite the removal of the tab. We’ll see.

Instagram is removing the Shop tab, moving Reels from the center spot in design overhaul next month

Weekly News

Android Updates

- Google is working to fix a Google Play issue impacting missing app changelogs, according to an Android Police report.

- The latest stable release of the official IDE for building Android applications, Android Studio Electric Eel (2022.1.1), arrived. The release includes updates and new features that cover design, build & dependencies, emulators & devices, and IntelliJ, Google said.

- Google released the Extension SDK to developers, bringing features like the Android 13 Photo Picker API and AdServices APIs to Android 11 and up.

Apple News

- Second developer betas for iOS 16.3, iPadOS 16.3, watchOS 9.3, macOS Ventura 13.2 and tvOS 16.3 have arrived. One notable change impacts the new Emergency SOS feature. The “Call with Hold” option is renamed to “Call with Hold and Release,” as now the call to emergency services won’t go through until users let go of the buttons they press down to start the SOS call. More here. The change may be an attempt to address issues over mistakenly triggered calls.

- Seems like Apple pushed Flickr to update its SafeSearch filtering. The company said it updated the feature so it won’t return results for “bad words” when it’s enabled in order “to act in compliance with Apple’s policies.”

- Bloomberg’s Mark Gurman reported that iOS 17 is going to be a smaller release with fewer changes as Apple focuses on its mixed-reality headset.

- Apple Maps now lets businesses update their listings and tout promotions via a new Apple Business Connect portal. No plans yet for any sort of Maps ads offering, however.

- In a year-end review, Apple announced it has now paid out a record $320 billion to app developers since 2008 — a number that reflects the revenue apps have generated, minus Apple’s commission. The company now has more than 900 million paid subscriptions across Apple services, with subscriptions on the App Store driving a “significant” part of that figure, it said.

Gaming

- Google and Nvidia shared concerns with the FTC as to how Microsoft’s Activision Blizzard deal would give it an unfair advantage in cloud, subscription and mobile gaming.

- JioGames, part of Reliance Industries’ telecom platform Jio, announced a 10-year strategic partnership with France’s Gamestream. The latter will assist JioGames in bringing cloud gaming to “1.4 billion” Indians by helping scale the JioGamesCloud platform. JioGames’ titles can be played on Android, web (PC, Mac and iPhone), and Jio’s set-top boxes.

- Roblox could be coming to a new platform: Meta Quest. Sources told The Verge that Roblox will be expanding its VR footprint — it already works on Rift and HTC’s Vive — by releasing to Meta’s Quest, which doesn’t require a PC to play.

- Stardew Valley’s big update, patch 1.5, finally reached iOS and Android users. The update, which arrived on consoles in 2021, includes a number of new features and changes, including a new beach farm layout, new NPCs and enemies, ostriches (!!) and a new location called Ginger Island.

Twitter Drama

- Twitter’s API began experiencing issues that are impacting third-party Twitter apps like Tweetbot, Echofon and Twitterrific. The app makers confirmed the problems have been causing log-in issues for users and their apps no longer work.

- Online publishing platform Medium, originally created by Twitter co-founder Evan Williams, announced that it’s embracing the open source Mastodon platform by creating its own instance to support its authors and their publications. Access to the instance will be offered through a Medium membership, which means in a way, it’s the first paid instance to come to Mastodon.

- Twitter’s Blue subscription, which is the new way to be verified and get your checkmark — degrading the value of checks in the process! — rolled out to Japan. Users can subscribe for ¥980 (around $7.40) per month on the web and ¥1,380 ($10.42) per month on iOS, a bit lower than U.S. prices of $8 per month on the web and $11 per month on iOS.

- Twitter made the algorithmic timeline the default and renamed it the “For You” feed. (Eye roll). You can now swipe between the For You feed and a chronological timeline, as well as lists.

Entertainment

- TikTok is alpha testing a Talent Manager Portal with select talent agencies. The service would allow creators’ agents and reps to oversee, execute and analyze brand deals their clients are being offered.

- Apple Music and the Apple TV apps quietly launched on the Microsoft Store — a few months after Microsoft said the apps would be coming to Windows 11.

- YouTube will begin sharing ad revenue with Shorts creators on February 1, and will update its YPP terms to reflect this. (Take that, TikTok!)

Etc.

- Failed discount movie tickets service MoviePass is trying for a comeback with funding from crypto backers, Animoca Brands. 😒

- Google added emoji reactions to Meet video calls, starting on iOS and web, with Android to follow. The feature was announced last year.

- Not so super. Tata Group’s super app Tata Neu is expected to meet only half its sales target in its first year — $4 billion versus an $8 billion target. The app had been modeled on successful apps like Alipay and WeChat.

- Tinder and other Match dating apps will introduce tips on how to avoid romance scams. Someone watched “The Tinder Swindler,” apparently!

Government & Policy

- TikTok’s CEO, Shou Zi Chew, met with senior European Union lawmakers to answer a number of questions including privacy, data protection, DSA compliance, child safety, Russian disinformation and the transparency of paid political content. The inquiry follows what’s expected to be increased regulatory scrutiny of the app, including possible oversight by the European Commission.

- After being fined $400 million by Ireland’s Data Protection Commission over how Instagram handled minors’ accounts and data, Meta announced it would remove the ability for advertisers to target teen users by gender. The company will also end personalized ad targeting to users under 18 based on in-app activity, like who they follow on Instagram and what Facebook pages they like.

- New Jersey and Ohio have now joined 20 other U.S. states in banning TikTok on government-owned devices over security concerns.

- The U.S. Supreme Court declined to block a lawsuit filed by WhatsApp that challenged the alleged mass phone hacking by Israeli spyware maker NSO Group. The spyware maker had argued the suit should be dropped because it was acting on behalf of a foreign government, but the Supreme Court rejected this claim.

Funding

- A Twitter rival called ‘T2’ raised its first outside funding, with $1.1 million from a group of high-profile angels including Bradley Horowitz, Rich Miner and the former CEO of Wikipedia, Katherine Maher. T2 founder Gabor Cselle has sold startups to Twitter and Google previously.

- Payments technology platform Butter Payments raised $21.5 million in Series A funding led by Norwest at a ~$100 million valuation. The company leverages AI to help end accidental churn.

- Kakao Entertainment, which publishes apps for popular animated shows and novels, raised $930 million from Saudi Arabia’s PIF and Singapore’s GIC.

- A company developing a cognitive behavioral therapy platform for ADHD, Inflow, raised $11 million in Series A funding. Inflow’s self-help app offers daily exercises and challenges focused on habit development, mindfulness techniques, community support and more.

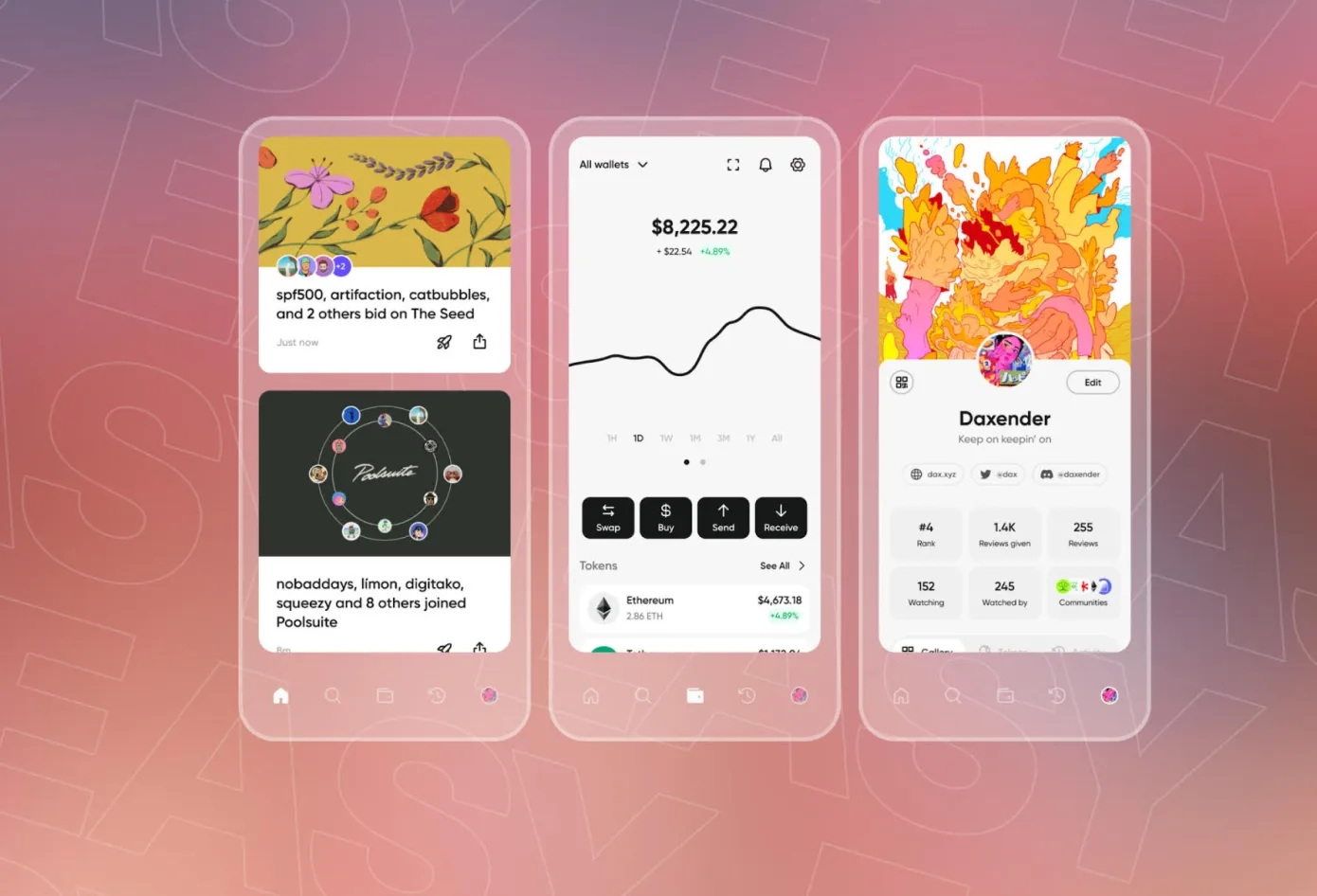

- Social crypto wallet app The Easy Company raised $14.2 million in seed funding. The iOS and Android app offers an Instagram-like experience for showcasing NFTs.

Layoffs

- Tokyo-based news aggregator SmartNews laid off 120 people in the U.S. and China, with plans to implement a voluntary workforce reduction in Japan.

- Fintech for kids Greenlight, which lets kids use a debit card and app with parental monitoring, laid off 104 employees — or more than 21% of its total headcount of 485 employees.

- Crime-reporting app Citizen laid off 33 employees, including at least 10 engineers. The app uses public police blotters to notify users about verified incidents in their area, but also allows users in select markets to upload their own reports and livestream.

- Right-leaning Twitter alternative Parler’s parent company laid off 75% of staff and chief execs, leaving Parler with just 20 employees. Kanye, as many expected, didn’t actually buy it.