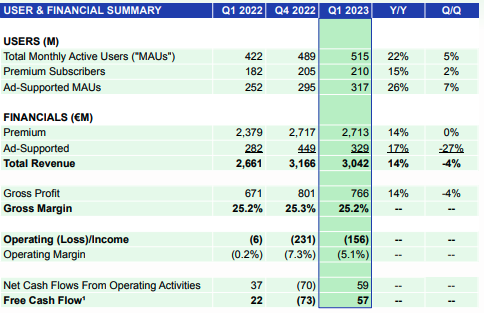

Spotify now has 515 million monthly active users (MAUs), representing a 5% increase on the previous quarter and 22% increase on the corresponding period last year.

This is the first time Spotify has claimed a user base in excess of half-a-billion users, with 210 million premium subscribers and 317 million on the ad-supported plan. However, it represents a ratio of 40% paid-to-free listeners, a ratio that seems to be in free-fall.

For comparison, Spotify’s premium subscribers constituted 46% of its overall user base in Q1 2019, falling to 45% in Q1 2020, 44% in Q1 2021 and 43% in Q1 last year, before dropping to just under 42% for the previous quarter.

A two-percentage point drop in the premium-to-free listeners ratio from quarter-to-quarter seems significant. It’s not clear how many premium subscribers may be switching to the free ad-supported tier, but it is clear that Spotify’s ad-supported user base is outpacing its premium subscribers, quite possibly due to consumer cost-cutting due to the economic downturn.

This isn’t translating into ad-supported revenues, however. Spotify’s figures show that while its income from advertising grew 17% year-on-year, it actually fell by 27% on the previous quarter, with its total revenue dropping by 4% (though it increased by 14% on a year-on-year basis).

The company acknowledged that its revenue growth fell below expectations due to “macro-related variability in our advertising business.”

However, Spotify is keen to stress that its MAUs grew by 26 million users overall versus a guidance of 15 million, making it the company’s single-biggest Q1 net growth and second largest quarterly growth in its history. Now, if only it could convert more of them to premium subscribers.

Join 10k+ tech and VC leaders for growth and connections at Disrupt 2025

Netflix, Box, a16z, ElevenLabs, Wayve, Hugging Face, Elad Gil, Vinod Khosla — just some of the 250+ heavy hitters leading 200+ sessions designed to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss the 20th anniversary of TechCrunch, and a chance to learn from the top voices in tech. Grab your ticket before doors open to save up to $444.

Join 10k+ tech and VC leaders for growth and connections at Disrupt 2025

Netflix, Box, a16z, ElevenLabs, Wayve, Hugging Face, Elad Gil, Vinod Khosla — just some of the 250+ heavy hitters leading 200+ sessions designed to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss a chance to learn from the top voices in tech. Grab your ticket before doors open to save up to $444.

Another notable takeaway from its Q1 2023 shareholder report relates to its operating losses. While its losses this time around were an improvement on the last quarter (€156 million versus €231 million on Q4 2022), the company is forecasting this trend to continue, with a projection of €129 million in operating losses for Q2 2023.