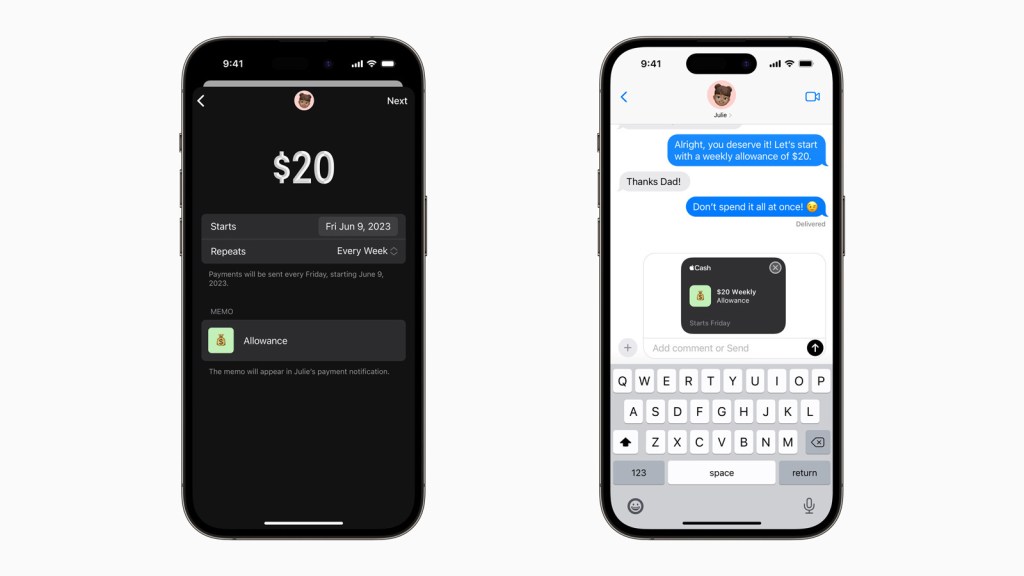

Apple’s iOS 17.4 update is primarily about adapting iOS to EU’s Digital Market Act Regulation. But the company has also released a new API called FinanceKit that lets developers fetch transactions and balance information from Apple Card, Apple Cash and Savings with Apple.

At launch, the company has partnered with YNAB, Monarch and Copilot. In a post on X, Copilot said that users would be able to track all Apple finance accounts in real time. Previously, Copilot users needed to upload documents to see their transactions.

The most requested credit card integration is now live on Copilot Money 💳

Starting today, Copilot can keep track of your Apple Card, Apple Cash, and Savings accounts. Try it today → https://t.co/wlO9aD0B9X

Keep reading to learn more!

1/4 🧵 pic.twitter.com/7fFnQkj7pY

— Copilot Money (@copilotmoney) March 5, 2024

Join 10k+ tech and VC leaders for growth and connections at Disrupt 2025

Netflix, Box, a16z, ElevenLabs, Wayve, Hugging Face, Elad Gil, Vinod Khosla — just some of the 250+ heavy hitters leading 200+ sessions designed to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss the 20th anniversary of TechCrunch, and a chance to learn from the top voices in tech. Grab your ticket before doors open to save up to $444.

Join 10k+ tech and VC leaders for growth and connections at Disrupt 2025

Netflix, Box, a16z, ElevenLabs, Wayve, Hugging Face, Elad Gil, Vinod Khosla — just some of the 250+ heavy hitters leading 200+ sessions designed to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss a chance to learn from the top voices in tech. Grab your ticket before doors open to save up to $444.

“We are thrilled to be one of the first apps selected by Apple to bring this feature to life,” Todd Curtis, CEO of YNAB said in a statement. “Since 2004, YNAB has been focused on helping people change their relationship with money, and we are excited that this integration will enhance the YNAB experience for Apple Card holders, making it even easier for them to spend confidently, save aspirationally, and even give joyfully.”

Over the years, Apple has increased the number of financial products it offers. It released the Apple Card in 2019. Earlier this year, it said that Apple Card users earned $1 billion in daily cash rewards in 2023. The company also said that more than 12 million customers are using Apple Cards. In April 2023, Apple launched a savings account with a 4.15% APY in partnership with Goldman Sachs. In August 2023, the company said the new savings account already had more than $10 billion in deposits.