Speakers

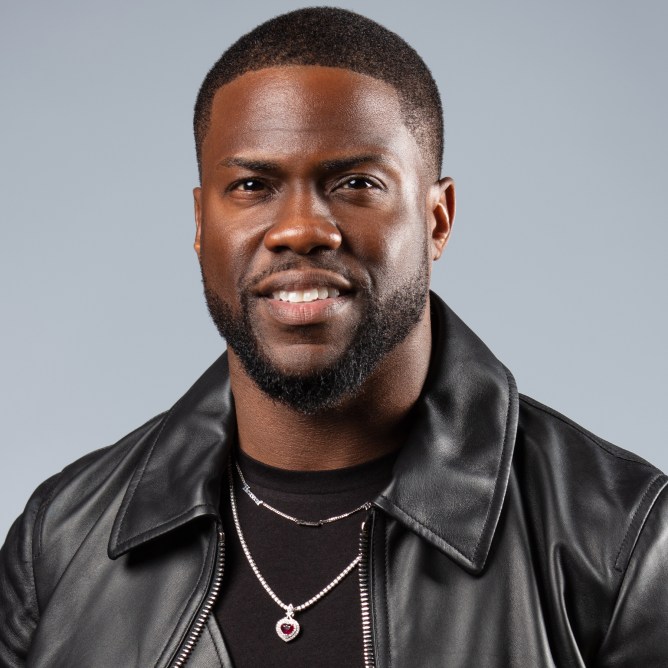

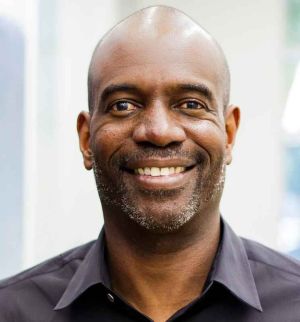

CEO & Founder Esusu Financial Inc.

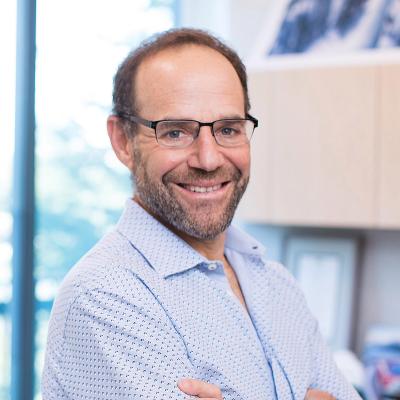

Founder & Portfolio Manager Irving Investors

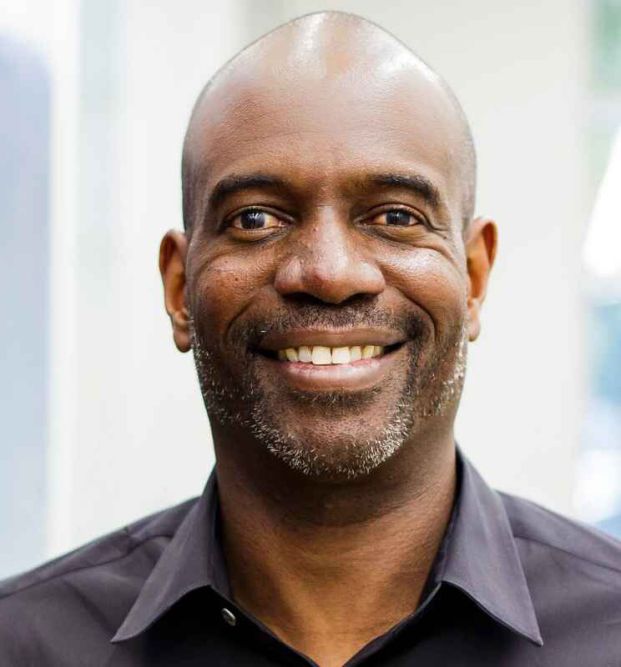

General Partner defy.vc

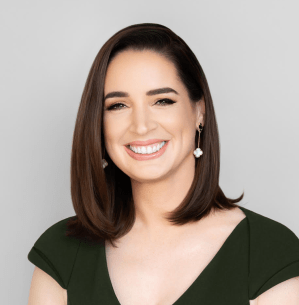

Co-founder & President Cityblock Health

Operating Partner Fast Forward Venture Studio

CEO & Founder CapWay

Angel Investor Trail Run Capital

EVP & Chief Growth Officer VOSKER

Director Franklin Venture Partners

General Partner M25

Co-founder and CEO Wehype

Consultant Egon Zehnder

Managing Partner Fast Forward Venture Studio

Chief Marketing Officer Cloudinary

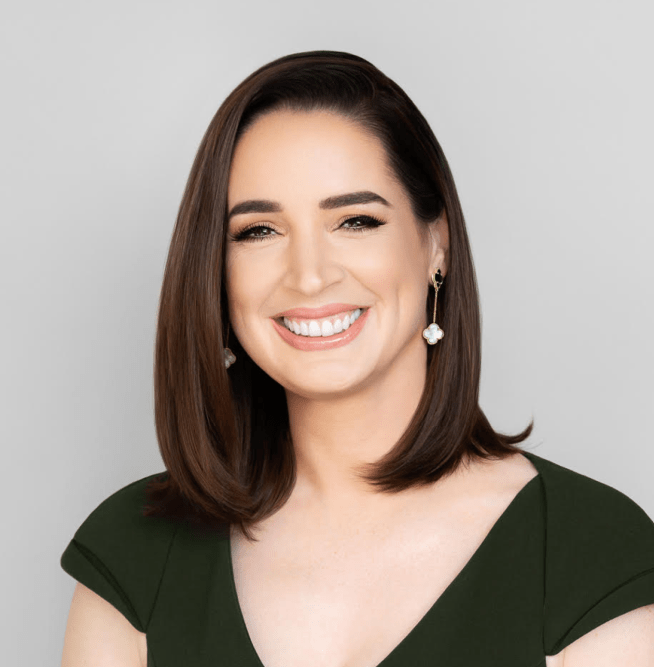

CEO and Co-founder Queenly

Managing Director, J.P. Morgan’s Middle Market Banking and Specialized Industries Business J.P. Morgan

Partner Mayfield

Founding Partner LoftyInc Capital Management

Co-founder & CEO Sila

Chief Executive Officer Terray

Chief Product Officer Reddit

CEO & Founder Q-CTRL

Associate Scout Ventures

Chief Strategy & Operations Officer (CSOO) OnlyFans

Partner QED

Managing Director General Catalyst

Founder & CEO Remynt

Partner NEA

Founder & Managing Partner Stellation Capital

Venture Partner Fast Forward Venture Studio

Co-founder & CEO Rafay Systems

Co-founder and CEO Vektor AI

Consultant Egon Zehnder

Threat Analyst Emsisoft

CEO & Cofounder Spinwheel

Partner Kleiner Perkins

Founder & CEO Worthix

Managing Partner Mayfield

Partner Sequoia Capital

Co-founder & CEO Chief

Managing Director General Catalyst

Co-founder & CEO Rippling

Executive Director in the Office of Disability Inclusion J.P. Morgan

Co-founder & CEO Clubhouse

Head of Marketing Monte Carlo

Founder & Managing Partner a16z crypto

CEO & Executive Director Stellar Development Foundation

CEO All Raise

Co-founder & CEO Fiveable

CEO & Co-founder 7th Ave

CEO & Co-founder Carbon

Co-founder & CEO Alloy Automation

Co-founder & Managing Partner BBG Ventures

Co-founder & Co-CEO Brex

Head of Digital Investment Banking & Digital Private Markets J.P. Morgan

Director, New and Emerging Business LinkedIn

Co-founder & CEO Metafy

SVP & General Manager, Call of Duty Activision Blizzard

Co-founder & CEO Figma

Venture Partner Volition Capital

Partner Anthemis

CEO Fivetran

CEO OnlyFans

CEO Techstars

Co-founder and CEO FROGED

Senior Reporter Protocol

COO Virtual Gurus

Co-founder & CEO Ramp

Surveillance and Cybersecurity Counsel American Civil Liberties Union (ACLU)

NBA 4 X Champion & Host The Draymond Green Show

Founding Partner Forerunner

CSO & Cofounder BigHat

Venture Partner Fin Capital

Partner Mayfield Fund

Managing Director, Co-Head of Technology and Disruptive Commerce Group JP Morgan Chase

Managing Director, YC Continuity Y Combinator

Advisor FTX

Brand Partner Fabletics Men

Partner Bessemer Venture Partners

Founder & CEO Firstbase

Partner Reach Capital

Co-founder and CEO Zencargo

Founder BRCK

Founding Managing Partner Pear VC

President Xsolla

Founder & CEO Parthean

Partner Base10 Partners

Founding Partner, Seven Seven Six

Chairman & CEO MoneyGram

Senior Director LinkedIn

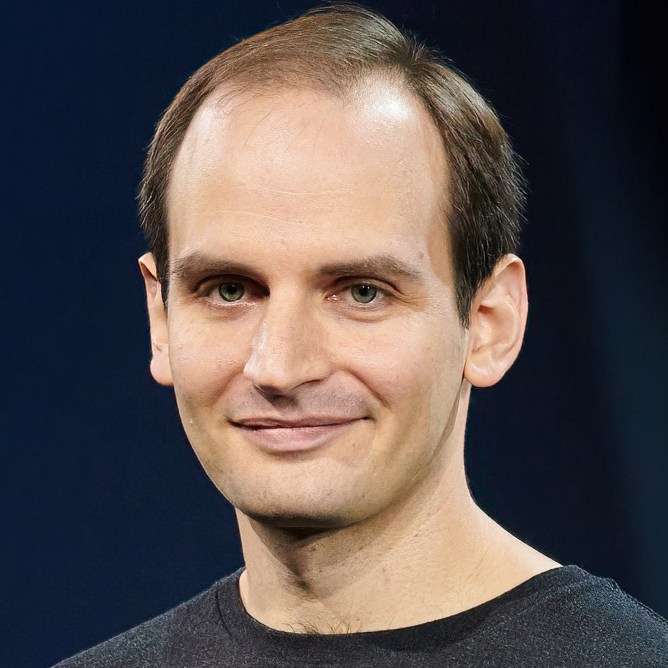

CEO TuSimple

President and CEO The Aerospace Corporation

Head of Business Development, North America Marqeta

CEO & Cofounder ZaiNar

Founder & CEO Securiti

Manager, Startups LinkedIn

Partner Forerunner Ventures

Host & Founder Mobile Tech Podcast

Managing Director Global Head of Alternative Investments J.P. Morgan

Director, Growth LinkedIn

Co-founder & Chief Brand Officer Chief

Investor Precursor Ventures

Chief Growth & Innovation Officer Connection

Chief Data Architect, Analytics Data Platform Autodesk

CEO AngelList

SVP Growth Verticals FIS

Co-founder & COO Faire

Director of Communications Samsung Next

Founder & CEO Airbase

Co-CEO and Co-Founder Stash

Chief Developer Evangelist & CMO SingleStore Inc.

COO Uniswap Labs

CEO Yahoo

VP of Product CDK Roadster CDK Global

CEO & Cofounder Alpha Medical

Co-founder and Co-CEO Tiny Organics

Senior VP Talent & Culture VOSKER

CEO & Co-Founder Buoy Health

Founder & Managing Partner Cowboy Ventures

Chief Technology Officer AT&T

General Partner a16z

Director, Open Government Products Open Government Products

Head of Community and Managing Partner Dorm Room Fund

CEO & Cofounder Otter.ai

CEO & Cofounder Saga

CEO Foursquare

Head of Portfolio Capital & Investments Techstars

Founder, Chairman & CEO Wonder Group

Head of Product DevRev, Inc.

Consultant Egon Zehnder

CEO & Co-founder Chronosphere

Managing Partner Kindred Ventures

Founder & CEO 2Gether-International

General Partner Coatue Management L.L.C.

Founder & CEO Renegade Global

Co-founder Boddle Learning

Managing Director – MM Specialized Industries Industry Verticals J.P. Morgan

CIO & Head of Digital Technology and Innovation Wells Fargo

General Partner The Fintech Fund

Global Head of Industry Research InterSystems

Co-founder & General Partner Better Tomorrow Ventures

Senior Vice President, North America Digital Partnerships Mastercard

Founder & CEO Luta Security

Director, Commercial Systems Program Office National Reconnaissance Office

General Partner GV

Co-founder and CEO BUX

Managing Partner, HartBeat Ventures CEO, XPV Group

EVP, Head of Innovation Wells Fargo

Co-founder & Managing Partner Next Play Capital

General Manager, Customer Advisory Service VOSKER

Co-founder & Managing Partner Tusk Venture Partners

General Partner Black Operator Ventures

Partner Upfront Ventures

Partner Index Ventures

CEO Campfire

Talent Director Sequoia

Managing Director Kapor Capital

Founder & CEO Next Step

Co-founder & CEO WorkBoard

CEO & Cofounder DevRev

Partner Mayfield Fund

Chief Product Officer Calendly

CEO & Cofounder Ethena

Contributor

VP of Product Management Marqeta

Partner Index Ventures

SVP of Strategic Payments Systems Stride Bank

Vice President Forgepoint Capital

Founder, CEO & Managing Partner The Engine

CMO Mayfield

Co-Founder & Co-CEO Yugabyte

CEO Apollo GraphQL

Founding & Managing Partner Serena Ventures

Co-Founder & CEO Crossing Minds

Founder and CEO CIONIC

Chief People Officer MURAL

President & Co-founder HartBeat Ventures

Cofounder, Investor, Advisor Nakoshi

Founder Price Theory

Founder & Managing Partner Leadout Capital

CEO & Cofounder Cube

Co-founder and COO Natrion

VP & GM of North America Multiverse

Founder & CEO Etalon

VP, Product Management LinkedIn

Co-founder Future Ventures

CEO and Co-founder Lumos

Founding Managing Partner Freestyle VC

Founder & CEO Rivian

Founder & Managing Partner Felicis

CEO & Co-founder Chipper Cash

Founding Partner Venturous Counsel, a Professional Corporation

CEO alphaa.io

EVP and Chief Product and Technology Officer CDK Global

Co-founder and CEO Ribbon

General Partner Lux Capital

Chief Product Officer FOXO Technologies

Co-founder & Managing Partner Flourish Ventures

Head of Crypto Visa, Inc.

Founder, Chief Design Officer Pronto Media Group

Lecturer in Management Stanford Graduate School of Business

Co-founder & Executive Chairman Animoca Brands

Founder Couplet Coffee

Startup Acquisition: Pilots Lead Amazon Web Services

Co-founder and CTO Nylas

Security Researcher, Project Zero Google

Director of Product Management, Pricing & Data Opendoor

Founder & CEO SYLVAIN

Co-founder & Partner Pentas Ventures

Co-founder Boddle Learning

Chief Revenue Officer Chargeebee

Managing Partner BoxGroup

Founding Managing Partner Plexo Capital

Founding Partner & CEO 500 Global

Portfolio Manager, Global Technology Strategy T. Rowe Price

CEO & Cofounder Bumpa

Partner Khosla Ventures

Vice President, Games Netflix

Co-founder & CEO Curated

Managing Director Equity Capital Markets, J.P. Morgan

Head of Product Alloy

General Partner Engine Ventures

Senior Manager, North American Digital Sales Mambu

Founding & Managing Partner Serena Ventures

Partner Accel

Startup Coach & Fractional Founder Fundable Startups

General Partner, SOSV & CTO, IndieBio SOSV

CEO Polygon Studios

SVP Venture Investments, FIS Impact Ventures FIS

Co-founder, Solana & CEO Solana Labs

Head of Partnerships Checkout.com

Vice President, Talent Gusto

Co-Founder & General Partner Hustle Fund

Web3 Angel Investor & Product Lead Defi Pulse

CEO & Co-Founder Altschool

CTO and Co-founder Queenly

Co-founder &President Lyft

Principal, Healthcare & Life Sciences, Amazon Web Services AWS

Co-founder & CEO Firehawk Aerospace

Co-founder & CEO UrbanKisaan

Founder & Managing Partner Stellation Capital

Managing Partner Precursor Ventures

Development Partner Commerce Ventures

CEO Interchecks

Senior Director, Equity Strategy Secfi

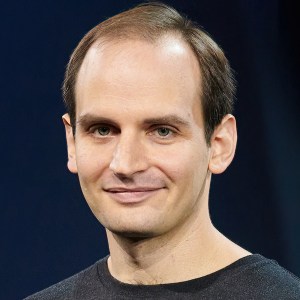

Abbey grew up in the slums of Lagos, Nigeria, and came to the United States when he was 17 years old. His personal experiences inspired Abbey and his co-founder to start Esusu, a financial technology company that helps low- to moderate-income households use their on-time rent payments to build credit. Prior to Esusu, he created a global social venture which provided affordable access to clean water for over 250,000 people in eight emerging countries. In addition, he founded data analytics company Open Aid Initiative which was acquired in 2014. Abbey’s early career includes roles at Accenture, Goldman Sachs, and PricewaterhouseCoopers (PwC). Beyond Esusu, Abbey serves as a Queen’s Young Leader and member of the Royal Commonwealth Society. He graduated Magna Cum Laude from the University of Minnesota with a B.S. in Business Management and earned his M.P.A. from New York University’s Robert F. Wagner Graduate School of Public Service. In 2020, Abbey was recognized on Forbes 30 Under 30 list. In 2021, he was selected by Goldman Sachs as one of the 100 Most Intriguing Entrepreneurs.

Wemimo's Sessions

What Happens When We Don’t Have Diverse Voices in the Room to Help Shape the Future? @ Breakout Session #1

Wemimo Abbey, the diverse co-founder behind Esusu, shares the Inspirational story behind his innovative startup and the challenges he and his co-founder faced along the way. As minorities, they encountered unique challenges, and with the help of J.P. Morgan, the founders overcame them to ultimately reach their goals. Diversity, Equity, and Inclusion isn’t just a check in the box, why is it so important? In this session we will discuss the benefits of including minority voices in startups and how to ensure DEI.

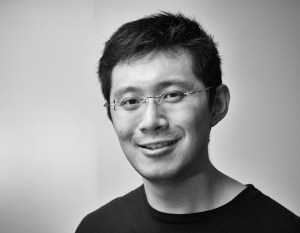

Jeremy Abelson is the founder and lead portfolio manager of Irving Investors.

Jeremy's Sessions

Expanding the Ecosystem: How to Get Institutional Investors Invested in You @ Breakout Session #1

Hear from institutional investors about their growing interest in private markets. They’ll share their thoughts on what makes a good investment and how to get their attention.

As a General Partner at Defy, Medha is fortunate to support exceptional entrepreneurs from day zero through hyper-growth. Whether building her own startups or partnering with founders, she has experienced the highs and lows of company-building—sometimes all within the same hour. It’s one of the hardest, loneliest jobs in the world, which is why she believes founders need trusted partners who can be there for anything, big or small. Medha strives to be that person. Before Defy, she spent seven years as a Partner at Redpoint Ventures, focused on early-stage fintech, vertical SaaS, marketplaces, and healthcare. She had the privilege of working with companies like Whatnot, Tend, Proper Finance, LiveKit, and Anvyl—founders who taught her as much as she supported them. Medha began her career at Bain & Company, founded two startups (Skedge.me and Roomidex), and started her investing journey at Bessemer Venture Partners. Born in New York to immigrant parents, she’s the eldest of three and shaped by the values they modeled—grit, humility, and continuous improvement. She studied Social Studies at Harvard College and rowed on the varsity lightweight crew team, where she learned what it means to push past limits for your team. She later attended Harvard Business School and now lives in Marin with her husband and three kids. Most weekends, they’re outdoors exploring, and she still squeezes in a morning workout—old habits die hard. Medha is proud to be part of Defy and to continue backing the next generation of iconic founders.

Medha's Sessions

What The Startup World is Really Like For Underrepresented People

EBIT margins for companies with diverse management teams were nearly 10% higher than for companies with below-average management diversity. So how can we support diverse founders? From VC investments to building management teams, what should your approach to diversity and inclusion be? This panel will offer insights based on real experiences as under-represented founders and investors.

Dr. Toyin Ajayi is co-founder and CEO of Cityblock Health, a tech-enabled, value-based healthcare provider for Medicaid, dually-eligible and lower-income Medicare beneficiaries in underserved communities. Cityblock’s model of care meets individuals where they are, delivering highly personalized medical care, behavioral health care, and social services to members in neighborhoods where it’s needed most. Prior to Cityblock, Dr. Ajayi served as Chief Medical Officer of Commonwealth Care Alliance, a nationally renowned integrated health plan and care delivery system for individuals eligible for both Medicare and Medicaid. In this role, she led clinical operations, spearheaded care delivery innovations, and oversaw multi-disciplinary teams of clinicians, community health workers and administrators. Dr. Ajayi received her undergraduate degree from Stanford University, an MPhil from the University of Cambridge and her medical degree, with Distinction in Clinical Practice, from King’s College London School of Medicine. Board certified in Family Medicine, Dr. Ajayi completed her residency training at Boston Medical Center and continues to practice primary care with a focus on patients with chronic, complex and end-of-life needs. She has published and spoken extensively about her work in caring for populations with complex needs, including at TEDMED, NCQA, and HLTH, and in journals such as the New England Journal of Medicine and the Journal of the American Medical Association.

Toyin's Sessions

Making Care Actually Work

Cityblock Health has experienced considerable growth on the back of a care model designed to actually meet the recipients of care where they already are, while still satisfying the needs of payers. It seems to be true accessibility in a framework that works with the existing US healthcare infrastructure, but we’ll here from CEO Toyin Ajayi about the work that remains to be done.

Omolara Ajele is co-founder and operating partner at Fast Forward, a venture studio and fund focused on unlocking prosperity in Africa. At Fast Forward, she supports portfolio companies with strategy on GTM and scaling. She was employee no. 10 at Jumia (NYSE:JMIA) where she led partnerships for Nigeria and later was founding MD of Jumia Pay. Lara bagged her MBA at MIT and has also worked at Facebook and Charles Schwab in product and program management roles.

Omolara's Sessions

Why African Tech Needs Venture Studios @ Roundtable #9

Could venture studios deliver superior results when it comes to providing entrepreneurial solutions to hard problems in Africa?Entrepreneurship is about risk. The Venture Studio model claims to reduce that risk and maximize the learnings and may be even important in emerging markets where uncertainty is higher and a deep understanding of context and people is necessary. Studios around the world are getting a 34% exit rate VS 21% for Accelerators and 19% for the average venture industry. Is Africa ripe for venture studios, given the increase in back-able and experienced operators who are looking to launch companies. Let’s discuss how this model can be utilized for rapid introduction of new market models and opportunities. This is a roundtable discussion – come share your thoughts and learn from others.

Sheena Allen is an entrepreneur, author, speaker, and creative architect. She was born in Terry, MS, and is a graduate of the University of Southern Mississippi, where she received a dual degree in Psychology (B.S.) and Film (B.A.). In 2011 during her senior year in college, Sheena started her first tech company, Sheena Allen Apps, and bootstrapped the startup to generate millions of mobile app downloads. In 2019, she started executing on her second tech startup, CapWay, which gave Sheena the title of the youngest female in America to own and operate a digital bank. The fintech company focuses on creating economic access and opportunities for all through inclusive financial products and services, including banking, content, payments, and more. In 2016, Sheena made her film premiere in She Started It, a documentary that follows five women around on their startup journey. In 2022, Sheena starred in a second, this time solo and short documentary, created by Google for their Black Women in Tech series. In addition to film, Sheena has also released a print book titled The Starting Guide about her early journey in tech, being a non-technical founder, and business 101 tips.

Sheena's Sessions

What The Startup World is Really Like For Underrepresented People

EBIT margins for companies with diverse management teams were nearly 10% higher than for companies with below-average management diversity. So how can we support diverse founders? From VC investments to building management teams, what should your approach to diversity and inclusion be? This panel will offer insights based on real experiences as under-represented founders and investors.

Allison is a founder and helper for startups. Previously, she was co-founder & COO at Fast and Head of Product Operations for the Money Team at Uber. She started at Uber in 2014 and served in a range of Product, Ops, Strategy, and Leadership roles at the company, helping it scale from 2k to 26,000+ employees. Prior to Uber, Allison was a strategy consultant at PwC. Allison started investing in the stock market in 2012 and is a self-taught public equity investor. Through angel investing, Allison is able to combine her love of investing with her passion for coaching and mentoring young startups.

Allison Barr's Sessions

How To Manage Staff In A Remote, Asynchronous Reality

Companies big and small are figuring out how they are going to distribute and manage their workforces in 2022. After a few years when even the most traditional company was forced to go remote, startups are now having to choose between remote setups, hybrid teams or a return to the office. But no matter what they choose, all companies are going to have more remote staff than ever before. To help founders understand how to manage those staffers, Trail Run Capital’s Allison Barr Allen, Mural’s Adriana Roche and WorkBoard’s Deidre Paknad are joining us to talk about what works.

Danny is the EVP, Chief Growth Officer as well as one of the co-founders and board members of VOSKER. An experienced business developer, his corporate development and interpersonal skills has led to significant growth opportunities across various technological sector. Pulling knowledge and strength from over ten years of experience as a specialist business developer and go-to-market strategist, Danny’s truest passion and values lies in pursuing bold ideas whilst supporting and leading disruptive technologies throughout the globe. Admired for expressing a genuine commitment to changing the world, Danny Angers exhibits a great rigour around decision-making, all whilst creating a diverse and inclusive tech environment. Danny’s impressive professional career has, therefore, often been described as witnessing a humble man with not-so-humble strategies. Watching this self-made serial entrepreneur move, create, disrupt and reinvent the tech industry is that of true wonder and magic. Danny’s deep devotion to the unrelenting growth and power of technology not only makes him a VOSKER asset but an industry veteran whose renowned actions will continue to speak volumes – on both a local and global scale.

Danny's Sessions

Scaling Your Business During a Recession

In the past few years, we have faced the sudden consequences of a pandemic and now have the threat of recession looming overhead. With this background, the speakers will be explaining how they could achieve 582% growth for VOSKER in just 2 years between 2019 and 2021- especially considering the pandemic and global-chip shortage. VOSKER was established in 2018 and is a fast-growing company looking to be the next global technology leader. In this session, the main takeaways would be how to successfully pivot and adapt during unexpected challenges and use uncertain times as an opportunity to innovate. This will give participants key insights into how they can scale their business even during a recession.

Sara Araghi

Director, Franklin Venture PartnersSara Araghi is a director of Franklin Venture Partners, the firm’s specialized investment team that invests in private opportunities, focusing on mid- and late-stage companies it believes are poised for transformative impacts across multiple industries. In addition Ms. Araghi is a vice president, research analyst and portfolio manager for Franklin Equity Group. She specializes in the equity research and analysis of the softline and specialty retail industries and serves as Consumer Sector team leader. She is a portfolio manager on the Franklin Growth Opportunities Fund and FTIF Franklin U.S. Opportunities Fund (SICAV), as well as related portfolios. Ms. Araghi earned her B.S. in business administration and graduated with honors from the University of California, Berkeley. She is a Chartered Financial Analyst (CFA) Charterholder and member of the CFA Society of San Francisco and CFA Institute. Ms. Araghi was recognized by the San Francisco Business Times as one of the Most Influential Women in Bay Area Business for 2021.

Sara's Sessions

Expanding the Ecosystem: How to Get Institutional Investors Invested in You @ Breakout Session #1

Hear from institutional investors about their growing interest in private markets. They’ll share their thoughts on what makes a good investment and how to get their attention.

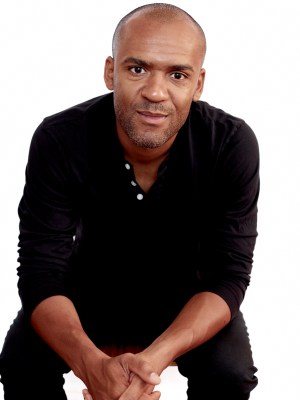

As a general partner at M25, Mike has managed over 100 investments in early-stage companies. Outside of his responsibilities at M25, Mike is a Kauffman Fellow (Class 24) and a national board member of BLCK VC, leading initiatives in the Midwest to connect, engage, empower, and advance Black venture investors. Prior to M25, Mike founded The Anvil, a co-working space and startup incubator on Purdue University’s campus, where he helped launch the first Purdue startup to be accepted to Y Combinator, and many more that have gone on to raise venture capital and get acquired. Mike lives in Chicago with his wife, Erikka, and in his free time, he enjoys making wine, eating sushi, following Chicago sports, and traveling.

Mike's Sessions

How To Raise In 2022 If You Are Not Located In A Major Hub

Sure, you no longer have to be located in Silicon Valley — let alone California — to build a startup or raise money. But there are still areas where there are more venture capitalists per square mile and areas where there are fewer. To get to grips on raising outside of traditional startup hubs, we’re bringing together VCs who either live and invest, or simply invest in more up-and-coming geographies. Mike Asem of M25, Rich Wong of Accel, and Hustle Fund’s Elizabeth Yin are joining us for this particular chat. It’s going to rock.

Meet the Speaker: How to Raise in 2022 If You're Not Located in a Major Hub

Join this small group discussion with select speakers in the TechCrunch+ Lounge. *You must have a current TC+ annual or 2-year subscription to access the TechCrunch+ Lounge*

Robin Åström

Co-founder and CEO, WehypeRobin Åström is CEO and Co-Founder of Swedish startup Wehype, the influencer marketing platform and agency that connects leading brands, such as EA, Microsoft, Ubisoft and McDonald’s, with billions of gamers worldwide.

Robin's Sessions

Love What You Do: Lessons from the Passion Economy @ Roundtable #4

In this roundtable session, Robin Åström, Co-founder and CEO of influencer marketing platform and agency Wehype, will lead a discussion on how the passion economy has democratized the ability to make money from creativity (and at scale), and the importance of startup founders operating within industries that they are genuinely, deeply passionate about. Robin will draw on his experience of turning his gaming obsession into a competitive edge, after identifying and filling a gap in the gaming influencer market with co-founders he met playing Counter-Strike as a teenager. Their love of gaming has provided them with the extra motivation to overcome challenges, enabling them to build Wehype into a rapidly growing and profitable business, working with some of the world’s biggest brands, including EA, Microsoft and Ubisoft.

Love What You Do: Lessons from the Passion Economy @ Roundtable #3

In this roundtable session, Robin Åström, Co-founder and CEO of influencer marketing platform and agency Wehype, will lead a discussion on how the passion economy has democratized the ability to make money from creativity (and at scale), and the importance of startup founders operating within industries that they are genuinely, deeply passionate about. Robin will draw on his experience of turning his gaming obsession into a competitive edge, after identifying and filling a gap in the gaming influencer market with co-founders he met playing Counter-Strike as a teenager. Their love of gaming has provided them with the extra motivation to overcome challenges, enabling them to build Wehype into a rapidly growing and profitable business, working with some of the world’s biggest brands, including EA, Microsoft and Ubisoft.

Anna Auerbach, based in New York, is a core member of Egon Zehnder’s Technology and Digital practice. Anna is an experienced advisor, founder, and operator. She works across advisory and search work, and has a particular focus on the intersection of product, technology and marketing for high-growth companies. Anna is also active in the firm’s HR officers practice. Prior to joining Egon Zehnder, Anna was the Cofounder and CEO of Werk, which pioneered Saas analytics for people policies and benefits. Werk’s software and data insights were featured in HBR, Fast Company, WSJ, Bloomberg, and other publications. Earlier in her career, Anna worked in consulting. She began her career at McKinsey & Co., where she focused on technology, media and telecommunications work. She then worked at two specialty consulting firms, leading one as the Chief Operating Officer. Anna earned a BA in economics and psychology from Brandeis University and an MBA from Harvard Business School.

Anna's Sessions

The CPO-to-CEO Pipeline @ Roundtable #8

The product function has never been as important as it is today. As we see it continuously evolve and expand in importance, are product leaders poised to develop into the next generation of CEOs? Join a discussion with advisors who offer their expertise in evaluating future CEOs, hearing how other product leaders have made this transition. Additionally, compare notes with others on what this trend, along with the expanding mandate of the product role, could mean for the function.

Rewiring Founders to Hire for Tomorrow @ Roundtable #6

It’s not news that founders face a lot of pressure to surround themselves with the right talent from day one. But high-growth companies face rapidly evolving needs for talent, and founders may not have received the right kind of training on how to interview candidates or what to look for. How can you ensure that you are hiring not just for right now but also for the future? Two leadership advisors with expertise in executive search for tech start-ups will give insight into the framework they use to evaluate talent as a company scales. As they shed insight on the right strategies for evaluating for a candidate’s future potential, they are also eager to hear from founders: what are your biggest hiring concerns? What do founders feel search firms don’t really “get” about the hiring process?

Rewiring Founders to Hire for Tomorrow @ Roundtable #8

It’s not news that founders face a lot of pressure to surround themselves with the right talent from day one. But high-growth companies face rapidly evolving needs for talent, and founders may not have received the right kind of training on how to interview candidates or what to look for. How can you ensure that you are hiring not just for right now but also for the future? Two leadership advisors with expertise in executive search for tech start-ups will give insight into the framework they use to evaluate talent as a company scales. As they shed insight on the right strategies for evaluating for a candidate’s future potential, they are also eager to hear from founders: what are your biggest hiring concerns? What do founders feel search firms don’t really “get” about the hiring process?

Trust as the New Currency in Tech @ Roundtable #9

“Trust dies, but mistrust blossoms.” -SophoclesThe conversation around data privacy has evolved to one that includes the concept of trust, and today’s start-ups have the benefit of hindsight when it comes to avoiding the mistakes that big tech made in years past when prioritizing growth over customer privacy. How do you learn from the mistakes and missteps of tech pioneers who have not kept trust at the forefront of their mission? How do you build trust into your processes from the beginning and then maintain it as an important pillar of your mission as you scale and grow?Our leadership advisory team wants to hear from attendees passionate about data security about how the conversation needs to change. What future challenges could there be to data privacy in your industry that you should be planning for today? And how you engage with your customers. How do you make things right with customers when things go wrong?

Opeyemi is a General Partner of Fast Forward, a venture studio and fund focused on unlocking prosperity for Africa. As an entrepreneur, he previously founded Moneymie, a crypto to fiat infra service, Jobberman, the largest online recruitment platform in Africa backed by Tiger Global; and Whogohost, a web hosting company in Nigeria.

Opeyemi's Sessions

Exit Pathways for Africa Startups @ Roundtable #7

As funding continues to grow on the African continent, we need to start understanding the paths to exit.We have seen a string of $50m+ African exits in the last 2 years; DPO to Network International, Paystack to Stripe, Sendwave to World Remit, Capricorn Digital to MFS Africa. We have also seen an IPO – Jumia. What should investors expect going forward? Sub $500m exits or IPOs? Who are these acquirers – global firms or African giants? Should founders be mindful of these trends and what should they do about it? This is a roundtable discussion – come share your thoughts and learn from others.

Saranya Babu is the Chief Marketing Officer for Cloudinary, the media experience cloud company for many of the world’s top brands. Saranya is a seasoned B2B marketing leader previously leading the marketing team at Wrike (acquired by Citrix in 2021) and Instapage, where she implemented, built and scaled sophisticated cross-functional marketing strategies. She has experience working in bootstrapped, VC funded, Private Equity owned, and public companies with proven success achieving 2X – 10X growth in revenue and valuation. She is a recipient of the 2021 Silicon Valley Women of Influence award and shortlisted in the 2020 B&T Women in Media award.

Saranya's Sessions

Building the Visual Economy Through Developer-Led Innovation

Over the last decade and accelerated by the pandemic, a huge part of the economy has shifted online driven mainly by technological advancements that offer comparable and even better online visual experiences than the physical ones. Unlike shifts that have been driven by executive leadership, this one has been driven by developers and entrepreneurs that have led the way in adopting cutting edge practices. Learn how developer driven innovation through approaches like API-first, headless, and composable architectures can help you engage better, faster and more effectively with your customers.

Trisha Bantigue

CEO and Co-founder, QueenlyTrisha Bantigue is the CEO and co-founder of Queenly, the leading online marketplace for the formalwear industry. She was recently featured on the 2022 Forbes 30 Under 30 as the main cover for the Art & Style category. Trisha was an emancipated youth who fought her way to survive in order to attain her college degree from UC Berkeley. Prior to founding Queenly, she has worked at some of the most successful tech companies such as Google, Facebook and Uber.

Trisha's Sessions

Art of Persuasion: How to Convince People to Work with You @ Roundtable #1

As a founder, the most important lesson that I’ve learned is to master the art of persuasion in order to convince just about anyone to work with you, as well as believe in your capability to execute a vision. In order to get an investor to see your big picture for your company, you have to confidently pitch and convince them that you are worth investing in. In order to get a cofounder to work with you for no pay and sacrifice their current stability, you have to prove to them that you’re a trustworthy partner and that you won’t quit on them when the going gets tough. In order to recruit top talent and build out a team, you have to sell the upside potential of joining early and to inspire them to follow you as their leader. These are all essential interpersonal skills that are often overlooked when the topic of “”what makes a great founder?”” comes up in tech articles, TED talks, podcasts, etc. You often hear about grit and technical skills, but those are ultimately useless if you can’t convince anyone to be on your team. Join this roundtable to discuss tools to gain the unique ability to convince others to be your advocate, and to stick with you til the very end, success or failure, to better equip yourself if you plan on starting a company.

Art of Persuasion: How to Convince People to Work with You @ Roundtable #2

As a founder, the most important lesson that I’ve learned is to master the art of persuasion in order to convince just about anyone to work with you, as well as believe in your capability to execute a vision. In order to get an investor to see your big picture for your company, you have to confidently pitch and convince them that you are worth investing in. In order to get a cofounder to work with you for no pay and sacrifice their current stability, you have to prove to them that you’re a trustworthy partner and that you won’t quit on them when the going gets tough. In order to recruit top talent and build out a team, you have to sell the upside potential of joining early and to inspire them to follow you as their leader. These are all essential interpersonal skills that are often overlooked when the topic of “”what makes a great founder?”” comes up in tech articles, TED talks, podcasts, etc. You often hear about grit and technical skills, but those are ultimately useless if you can’t convince anyone to be on your team. Join this roundtable to discuss tools to gain the unique ability to convince others to be your advocate, and to stick with you til the very end, success or failure, to better equip yourself if you plan on starting a company.

Leyonna Barba

Managing Director, J.P. Morgan’s Middle Market Banking and Specialized Industries Business, J.P. MorganLeyonna M. Barba is a Managing Director in J.P. Morgan’s Middle Market Banking and Specialized Industries business, leading the New York Technology & Disruptive Commerce (TDC) practice that serves high-growth, disruptive companies in the innovation economy. Advising clients at every stage in their growth profile, early to late stage, Leyonna is a skilled professional in an array of solutions ranging from operational optimizations, cash management, international growth and debt financing. Leyonna was named to Crain’s New York Business’ 2022 Notable Diverse Leaders in Banking & Finance. Prior to working in TDC, Leyonna spent more than 15 years in the investment and corporate banking practices at J.P. Morgan. She started her career in Debt Capital Markets advising clients on capital structure, M&A financing, leverage recapitalization and liability management. Leyonna earned a M.B.A. from Columbia University and a B.S. in Business Administration with a concentration in Finance and Accounting from Washington University in St. Louis. She is an active member of the New York Alumnae chapter of Delta Sigma Theta Sorority, Inc.

Leyonna's Sessions

What Happens When We Don’t Have Diverse Voices in the Room to Help Shape the Future? @ Breakout Session #1

Wemimo Abbey, the diverse co-founder behind Esusu, shares the Inspirational story behind his innovative startup and the challenges he and his co-founder faced along the way. As minorities, they encountered unique challenges, and with the help of J.P. Morgan, the founders overcame them to ultimately reach their goals. Diversity, Equity, and Inclusion isn’t just a check in the box, why is it so important? In this session we will discuss the benefits of including minority voices in startups and how to ensure DEI.

Rajeev Batra is an experienced investor and former enterprise software entrepreneur and executive. He helps lead Mayfield’s enterprise practice, focusing on Cloud and SaaS, and engages deeply with entrepreneurs on company building from the earliest stages. He has had a front-row seat to the trend of SaaS growing from systems of record to systems of engagement/action, by partnering with the founders of industry leading companies such as Marketo, Outreach, ServiceMax, SmartRecruiters, Crunchbase, Skilljar and WideOrbit. Rajeev holds an MBA from Harvard Business School, a Masters in Electrical Engineering from Cornell University, and a Bachelors in Electrical Engineering from the University of Maryland at College Park, where he serves on the Board of Visitors of the A. James Clark School of Engineering.

Rajeev's Sessions

How Startups Can Survive The Downturn With Financial Planning @ Roundtable #7

Whether you’re out looking for your first check or figuring out how to extend your latest funding round, the fundraising landscape has changed dramatically and holistic financial planning is more important than ever. Join Christina Ross, 3x CFO turned Co-founder & CEO of FP&A platform Cube, and Mayfield partner Rajeev Batra for a candid conversation on what startups need to survive today, including the key metrics investors are looking at, finding the balance between growth and operational efficiency, and more.

Idris “Afropreneur” Bello is a Founding Partner at Loftyinc Capital Management, an Africa focused venture fund with a stellar pre-seed and seed portfolio including Andela, Flutterwave, RelianceHMO, Trella, Chefaa, Early in his career, he worked with Chevron, ExxonMobil, the Clinton Foundation Health Access Initiative. A first class honors graduate of Computer Engineering from Obafemi Awolowo University, Nigeria, he has an M.Sc in Computer Science & Data Mining from the University of Houston; an MBA from Rice University and an M.Sc in Global Health Science from the University of Oxford, where he was a 2011 recipient of The Lord Weidenfeld Scholarship. Listed among CNN’s Top Ten African Technology Voices, he is a Singularity University Impact Fellow, Harambean Fellow, , MIT Global Start-up Fellow, SAP Ashoka Global Changemakers Award Winner, and a Nigeria Leadership Initiative Future Leader. He spends most of his time between Houston, Lagos, Cairo, and airport lounges.

Idris's Sessions

Why African Tech Needs Venture Studios @ Roundtable #9

Could venture studios deliver superior results when it comes to providing entrepreneurial solutions to hard problems in Africa?Entrepreneurship is about risk. The Venture Studio model claims to reduce that risk and maximize the learnings and may be even important in emerging markets where uncertainty is higher and a deep understanding of context and people is necessary. Studios around the world are getting a 34% exit rate VS 21% for Accelerators and 19% for the average venture industry. Is Africa ripe for venture studios, given the increase in back-able and experienced operators who are looking to launch companies. Let’s discuss how this model can be utilized for rapid introduction of new market models and opportunities. This is a roundtable discussion – come share your thoughts and learn from others.

Gene Berdichevsky is the CEO and Co-Founder of next-generation battery materials company, Sila. Under his leadership, Sila has become the first to industrialize and deliver in-market a new type of lithium-ion chemistry through the launch of WHOOP 4.0, which demonstrated an increase in energy density without compromising cycle life, power safety, or other performance parameters. Thanks to investments by blue-chip companies, including Mercedes and Daimler, Sila is working to scale up its science for the electrification of everything: consumer electronics, electric vehicles, electrified flight, and evolution of our power grid to greatly reduce our dependence on fossil fuels. Prior to co-founding Sila, Gene was the seventh employee at Tesla Motors where he served as Principal Engineer on the Roadster battery, leading the development of the world’s first, safe, mass-produced, automotive lithium-ion battery system. Gene holds two degrees from Stanford University; an MS in Engineering with a focus on energy and materials, and a BS in Mechanical Engineering. He has co-authored 42 patents and 4 academic publications.

Gene's Sessions

Building Companies with Longer Time Horizons

Not every startup can generate revenue from day one. From hardware to hard science, some startups take more time to build income streams. How can founders get around revenue concerns in a more conservative funding market? And how do investors weigh risk when it comes to bets that may take longer to pull off? For growing startup categories like robotics and climate, these are not idle questions. We’re bringing Sila’s Gene Berdichevsky, Index Ventures’ Erin Price-Wright and The Engine’s Milo Werner together to share the real nuts and bolts of early fundraising in 2022.

Speaker Q&A: Building Companies with Longer Time Horizons

Come with your questions for these experts speakers to chat about the real nuts and bolts of early stage fundraising in 2022.

Jacob is a distinguished inventor at the intersection of nanotechnology and synthetic chemistry. Prior to joining Terray full-time, he ran an NIH-funded lab at City of Hope, where he was an associate professor. He has more than 40 publications, 20 patents and over 11 thousand citations associated with his work. He was named one of the “Rising Stars and Young Nanoarchitects in Materials Science” by the Royal Society of Chemistry and was nominated for the Kabiller Young Investigator Award in Nanoscience and Nanomedicine. Jacob received his PhD in organometallic chemistry from CalTech where he studied with Nobel Laureate Bob Grubbs. Jacob completed his postdoctoral training at MIT and Rice University focusing on synthetic chemistry and nanotechnology, and received a BA in chemistry from Harvard University (magna cum laude).

Jacob's Sessions

Tech Driven Biology and Chemistry: Solving Science’s Hardest Problems at Scale @ Breakout Session #2

Join leaders in the AI-Driven Drug Discovery market for a fireside chat exploring how to build the next-generation of digital biotech. BigHat Biosciences, Terray Therapeutics and AWS will discuss topics including company building, science fact vs. fiction and the future of medicine. Understand how the intersection of biology and chemistry is enabling new techniques to develop novel therapeutics through the lens of technology. Walk away with insights from startup founders about building and running a startup that are applicable across all industries.

Before joining Reddit, Pali held senior leadership roles for more than ten years at Google. He recently led a nearly thousand-person team of engineers, product managers, user experience designers, and researchers across a high-growth product suite. Pali was also the vice-president of product management and led Google’s payment products globally. Before Google, Bhat held leadership positions at SAP Labs and McKinsey & Co.

Pali's Sessions

What Does Product-Market Fit Mean When Hype Tanks?

Reddit Chief Product Officer Pali Bhat, AngelList CEO Avlok Kohli and Calendly Chief Product Officer Annie Pearl are coming to Disrupt to help founders hone their definitions of product-market fit. The concept, often shortened to PMF, is tricky as it’s not easily defined for all startups at once. But one thing that happens when market sentiment takes a dive is that definitions tighten. So how should founders measure PMF in a more difficult market, from both a fundraising and customer perspective? We’ll find out.

Meet the Speaker: What Does Product-Market Fit Mean When Hype Tanks?

Join this small group discussion with select speakers in the TechCrunch+ Lounge. *You must have a current TC+ annual or 2-year subscription to access the TechCrunch+ Lounge*

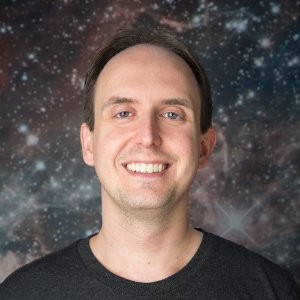

Michael J. Biercuk is the CEO and Founder of Q-CTRL, a quantum technology company focused on making quantum tech useful through quantum control infrastructure software. Q-CTRL is backed by global VCs including Airbus Ventures, InQTel, DCVC, Sierra Ventures, and Horizons Ventures, and works with leading quantum hardware providers including IBM and Rigetti. Michael is also a Professor of Quantum Physics and Quantum Technology at the University of Sydney and Chief Investigator in the ARC Centre of Excellence for Engineered Quantum Systems. He earned his undergraduate degree from the University of Pennsylvania, and his Masters and PhD from Harvard University. He held a research fellowship in the Ion Storage Group at NIST Boulder, and has served as a full-time technical consultant to DARPA, helping to steer government investments in quantum information and advanced computer architectures. Michael is a SXSW and TEDx speaking alumnus and a multi-time Australian Museum Eureka Prize nominee and winner.

Michael's Sessions

Three Ways to Leapfrog Your Competition Using Quantum Computing – Without a PhD

Quantum computing is everywhere you look – in mainstream press, tech news, investor newsletters. It’s described as transformational and disruptive; the quantum revolution is coming, and you’re told you will be left behind if you don’t get ahead. But how can someone without a PhD in quantum physics or an organization far from quantum computing research benefit? In this session we’ll give an accessible overview of quantum computing and outline three simple steps for anyone to take advantage of this transformational new technology – no PhD required!

At Scout, Jacqueline is focused on tackling the toughest problems through mindset and innovation. She’s passionate about generating maximal value creation and impact through web3/blockchain infrastructure. She helps source, diligence, and execute deals as well as support current portfolio companies and investor relations. Jacqueline graduated from the United States Naval Academy and went on the lead forward deployed teams as one of the few women in the Naval Explosive Ordnance Disposal Community. She continuously trained and built small unit teams for “no fail” missions that required coordination with federal agencies, foreign dignitaries and local authorities to conduct global operations out of the Middle East and Africa. Prior to Scout, she spent two years at JP Morgan working closely with founders and helped build out their early stage Technology and Disruptive Commerce practice. Jacqueline lives in NYC.

Jacqueline's Sessions

Famously Overlooked: How Underestimated Founders Survive and Thrive in a Competitive Market @ Breakout Session #1

It has been proven time and again that it is harder for diverse founder and funders to ‘make-it’ in venture. Hear from those who have beaten the odds and succeeded–what it took, how they feel about their success today and what they are doing to lift up others.

Keily is proud to serve as Chief Strategy & Operations Officer at OnlyFans. She is responsible for formulating, driving and communicating OnlyFans’ strategic initiatives and future goals to users, commercial partners, and other key stakeholders. Keily’s background is in law, operational strategy, and government affairs.

Keily's Sessions

How OnlyFans Changed the Internet’s Oldest Industry

Nothing drives tech innovation like sex. But after earning billions in revenue and providing stable income to thousands of adult creators, OnlyFans dropped a bombshell: it would ban porn. After creator backlash, those plans didn’t last long — the founding CEO stepped down, and now, Amrapali Gan and Keily Blair are in charge. Hear from these newly installed execs about what their leadership means for OnlyFans.

Laura Bock is a partner at QED and focuses on U.S. fintech investments. Prior to QED, Laura spent time advising financial institutions on growth, product, operations and strategy as a consultant at management consulting firm Oliver Wyman. Her work focused on banks, insurers and payment companies across North America. Laura also spent time at the World Economic Forum, where she led an initiative focused on bringing better financial infrastructure to emerging economies. Laura lives in New York City. Outside of work, she enjoys pickleball, board games and live music. Laura studied biophysics and biochemistry at Princeton University.

Niko Bonatsos is a managing director at General Catalyst Partners.

Niko's Sessions

State of VC in 2022

VCs have never had so much capital socked away — with $100 billion more in so-called dry powder than the end of last year, according to Preqin — but with a tightening exit market, many are ‘slowing their roll’ and asserting more control over deals after years of feverish dealmaking. What new terms are they introducing into deals? Where are they forging ahead — and pulling back — and why? What do founders need to know for their startups to survive and thrive in 2023 and beyond? For a clearer understanding of what’s happening on the ground right now, this will be a must-see conversation.

Gwyneth J. Borden is a seasoned public policy professional, who has worked in the public, private, and nonprofit sectors and for organizations ranging from the U.S. Senate to IBM to startups to trade associations. Gwyneth has a breadth of expertise, having worked in various industries, from IT to hospitality to manufacturing. Gwyneth is the founder and CEO of Remynt, which empowers consumers to rebuild their credit while resolving debt. A civic leader, Gwyneth serves as Chair of the San Francisco Municipal Transportation Agency (SFMTA), which oversees the transportation infrastructure and network in San Francisco. Gwyneth is also an Advisor to The Third Place, a YC-backed business subscription startup that enables independent businesses to capture recurring income and deepen customer loyalty. Gwyneth also serves on the nonprofit boards of SFFILM and The Edible Schoolyard Project.

Gwyneth's Sessions

Women of Disrupt Breakfast powered by Elpha Bay Area Meetup

Join the women attending Disrupt for networking and a panel discussion on Advocating for yourself and uplifting othersFIRST COME, FIRST SERVED – OPEN TO ALL WOMEN & THOSE WHO IDENTIFY AS WOMEN

Ann is a partner at NEA focused on early-stage investing in AI category creators, consumer and prosumer applications that shape our daily lives and user-centric business software. She loves working with visionary, technical founders who want to build iconic products and generational companies. Ann’s experience prior to NEA spans 5 pioneering tech companies, including 2 startup exits and business leadership roles at Uber and Twitter during their hyper-growth phase. She holds an MBA from Stanford and a B.S. from UC Berkeley.

Ann's Sessions

TechCrunch Startup Battlefield – Session 2

TechCrunch’s iconic startup competition is back, as entrepreneurs from around the world pitch expert judges and vie for the Startup Battlefield Cup and $100,000.

Peter A. Boyce II is the Founder & Managing Partner of Stellation Capital, an early stage venture capital firm headquartered in Brooklyn. Prior to this, Peter spent eight years as a Partner at General Catalyst, an $8B venture capital firm that invests in powerful, positive change that endures. In addition to his work at GC, he co-founded & advises Rough Draft Ventures: a funding platform to support technology entrepreneurship on university campuses. Peter is a graduate of Harvard University, earning a B.A. in Applied Mathematics and a Secondary in Computer Science. He grew up in New York City, where he graduated from Stuyvesant High School. He is proud to be a Ron Brown Scholar. Outside of his time investing, Peter serves as a non-profit board member to support communities he is passionate about: The Shed, The Studio Museum in Harlem, The New Museum, NEW INC, Code Nation, and the Harvard College Fund. He serves as a Rock Venture Capital Partner at Harvard Business School, Program Advisor for the HBS MS/MBA Program, and an MIT Sandbox Board Member.

Jake Bright is a writer, author and advisor with a focus on global business, politics, and technology. From 2017 to 2020, he was a contributing writer and advisor at TechCrunch where he published on Africa, mobility and politics. Bright helped spearhead consistent Africa coverage and co-produce the first Startup Battlefield competitions in Africa and Africa focused programming on the Disrupt San Francisco mainstage. Bright’s first book, The Next Africa (Macmillan 2015), forecast the rise of Africa’s venture backed startup scene. Prior to this he worked in international finance and as a speechwriter in Washington, DC. Bright continues to contribute occasional guest pieces at TechCrunch.

Jake's Sessions

Navigating Silicon Valley. – OG advice for African founders. @ Roundtable #6

Great product, great traction. New to the Bay Area and looking to raise? Let’s discuss how to navigate creating relationships and building your own network in Silicon Valley.A key part of unlocking funding for underrepresented founders is building relationships and networks. Many still have challenges doing this optimally. What should an ambitious founder from Africa do? Is the experience different from what other founders have been through? Let’s have a very open transparent discussion on how to show up, and build authentic and powerful approaches to Silicon Valley networking. This is a roundtable discussion – come share your thoughts and learn from other perspectives too!

Haseeb Budhani

Co-founder & CEO, Rafay SystemsHaseeb Budhani is the CEO and co-founder of Rafay Systems, which he co-founded in October of 2016. Prior to Rafay, Haseeb spent at a year at Akamai Technologies as the company’s Vice President of Enterprise Strategy. Akamai acquired Haseeb’s previous company, Soha Systems, in October 2016. Haseeb co-founded Soha in the second half of 2013 and served as the company’s CEO. Prior to Soha, Haseeb served as the Chief Product Officer for Infineta Systems, where he was responsible for overseeing all aspects of the company’s product marketing, marketing communications, and partner management activities. Prior to Infineta, Haseeb served as Vice President for NET’s Broadband Technology Group, spearheading the group’s product marketing, program management, and business development functions. Previously, Haseeb held senior product management, marketing, and engineering roles at Personal IT, Citrix Systems, Orbital Data, IP Infusion, and Oblix. Haseeb holds an MBA from UC Berkeley’s Haas School of Business and a B.S. in Computer Science from the University of Southern California.

Haseeb's Sessions

How to Recession-proof Your SaaS Startup @ Roundtable #3

During economic downturns, resources are in short supply and companies must find ways to reduce costs while continuing to deliver on business goals. In such situations, B2B SaaS companies are in a prime position not to just stay afloat but to find avenues of growth. How? Consuming critical capabilities as SaaS allows for quick and easy scaling of services – net-net, organizations can better utilize their resources for innovation, reduce costs (time, money), and deliver on company goals in times of economic distress. In this roundtable, we’ll discuss why SaaS startups must rethink their strategy during times of economic downturn, and evolve their GTM strategies to focus on revenue growth while reducing their overall TCO.

How to Recession-proof Your SaaS Startup @ Roundtable #3

During economic downturns, resources are in short supply and companies must find ways to reduce costs while continuing to deliver on business goals. In such situations, B2B SaaS companies are in a prime position not to just stay afloat but to find avenues of growth. How? Consuming critical capabilities as SaaS allows for quick and easy scaling of services – net-net, organizations can better utilize their resources for innovation, reduce costs (time, money), and deliver on company goals in times of economic distress. In this roundtable, we’ll discuss why SaaS startups must rethink their strategy during times of economic downturn, and evolve their GTM strategies to focus on revenue growth while reducing their overall TCO.

Anna Buldakova

Co-founder and CEO, Vektor AIAnna Buldakova is a co-founder and CEO of Vektor AI, a career development platform. Previously she was a Product Lead for AI products at Facebook, and a PM at Intercom, Yandex and various startups. Anna is also a product advisor for companies developing AI products.

Anna's Sessions

Hacking Hiring: How to Build an A-team without a Budget of a Large Corporation @ Roundtable #1

Success of your company depends on your ability to hire and retain talent, however, hiring has become an immensely complex and expensive process. How can you as a startup founder build an A-team without a budget of a large corporation? We’ll discuss some of the recent trends, research findings and founder lessons to help you answer that question. – How to create a job description that would stand out amongst thousands of others – How to hire people from top companies – How to balance different seniority levels – What startup founders need to know about hiring Gen Z – What psychological principles to keep in mind to build an A-team

Hacking Hiring: How to Build an A-team Without a Budget of a Large Corporation @ Roundtable #1

Success of your company depends on your ability to hire and retain talent, however, hiring has become an immensely complex and expensive process. How can you as a startup founder build an A-team without a budget of a large corporation? We’ll discuss some of the recent trends, research findings and founder lessons to help you answer that question.

Kristen Burke, based in Atlanta, is active in Egon Zehnder’s Consumer, Digital, and Technology practices. She applies deep insights gained from her own management and entrepreneurial experience to support clients, while focusing on founders, marketing and product officers. Kristen is especially passionate about and experienced in innovation, emerging technologies, and digital transformation. Prior to joining Egon Zehnder, Kristen spent more than 10 years at Georgia Pacific Consumer Products in various management roles, most recently as the Director of Innovation leading Smart Home IoT & Digital Experimentation. Earlier she worked as a Senior Consultant at Kalypso focusing on innovation. Kristen launched her career as a Sales Specialist at AstraZeneca.

Kristen's Sessions

Rewiring Founders to Hire for Tomorrow @ Roundtable #8

It’s not news that founders face a lot of pressure to surround themselves with the right talent from day one. But high-growth companies face rapidly evolving needs for talent, and founders may not have received the right kind of training on how to interview candidates or what to look for. How can you ensure that you are hiring not just for right now but also for the future? Two leadership advisors with expertise in executive search for tech start-ups will give insight into the framework they use to evaluate talent as a company scales. As they shed insight on the right strategies for evaluating for a candidate’s future potential, they are also eager to hear from founders: what are your biggest hiring concerns? What do founders feel search firms don’t really “get” about the hiring process?

Trust as the New Currency in Tech @ Roundtable #9

“Trust dies, but mistrust blossoms.” -SophoclesThe conversation around data privacy has evolved to one that includes the concept of trust, and today’s start-ups have the benefit of hindsight when it comes to avoiding the mistakes that big tech made in years past when prioritizing growth over customer privacy. How do you learn from the mistakes and missteps of tech pioneers who have not kept trust at the forefront of their mission? How do you build trust into your processes from the beginning and then maintain it as an important pillar of your mission as you scale and grow?Our leadership advisory team wants to hear from attendees passionate about data security about how the conversation needs to change. What future challenges could there be to data privacy in your industry that you should be planning for today? And how you engage with your customers. How do you make things right with customers when things go wrong?

Brett is a Vancouver Island-based Threat Analyst with cybersecurity company Emsisoft. Emsisoft is a partner in Europol’s No More Ransom project, has been involved in some of the most high profile ransomware incidents of recent years and has helped both companies and individuals avoid hundreds of millions of dollars in ransom demands.

Brett's Sessions

Winning The War On Ransomware

Ransomware attacks are escalating at an alarming rate. We’ll hear from experts about what winning the war on ransomware looks like and how startups can play their part.

Meet the Speaker: How to Create Robust Security Programs for Your Startup

Join this small group discussion with select speakers in the TechCrunch+ Lounge. *You must have a current TC+ annual or 2-year subscription to access the TechCrunch+ Lounge*

Tomas Campos is the CEO of Spinwheel, an intelligent consumer debt platform that helps Americans see, understand, and act on their debt in their favorite apps and services. For over 16 years, Tomas has been a noteworthy entrepreneur, and executive across payments, retail, consumer, and Saas businesses. He sold his previous company to Westfield Inc. and served as their SVP of product. Before Westfield, Tomas was the global general manager of the $1.5 billion digital payments division at Blackhawk Network Inc.

Tomas's Sessions

What The Startup World is Really Like For Underrepresented People

EBIT margins for companies with diverse management teams were nearly 10% higher than for companies with below-average management diversity. So how can we support diverse founders? From VC investments to building management teams, what should your approach to diversity and inclusion be? This panel will offer insights based on real experiences as under-represented founders and investors.

Annie Case is a partner at Kleiner Perkins where she focuses on investments in consumer, healthcare and marketplaces. Before joining Kleiner Perkins, Annie worked in product and business operations roles at Uber. While at Uber, she supported the SVP of Operations and helped scale the UberEats business to new markets internationally. Annie started her career as a consultant at Bain & Company in San Francisco, where she worked with clients in the technology, private equity, and education practices. Annie graduated from Stanford University with a B.S. in Human Biology and an M.S. Management Science & Engineering. She was also a member of the Stanford Women’s Soccer team.

Annie's Sessions

How To Raise First Dollars In A More Difficult Market, The Venture Perspective

It is clear by now that the venture market has changed this year. That means that founders looking to raise first capital for their startup can’t follow last year’s playbook and expect results. So what do founders need to know, and how can they best snag investor attention in a market where the rules are changing? We’re bringing together Annie Case of Kleiner Perkins, Reach Captial’s Jomayra Herrera and Sheel Mohnot of Better Tomorrow Ventures to share the real nuts and bolts of early fundraising in 2022.

Meet the Speaker: How to Raise First Dollars in a More Difficult Market

Join this small group discussion with select speakers in the TechCrunch+ Lounge. *You must have a current TC+ annual or 2-year subscription to access the TechCrunch+ Lounge*

Guilherme Cerqueira is the founder and CEO of Worthix, an Atlanta-based technology startup. He has +20 years of experience in Marketing Research, is a serial entrepreneur, and is a member of multiple accelerators and associations, such as 500startups, ATDC, ESOMAR, and Endeavor. Cerqueira majored in Psychology and has multiple degrees and certifications from renowned international institutions such as ENSEAD, Standford, and Harvard Business School.

Guilherme's Sessions

Look Beyond the Survey to Capture the True Voice of the Customer @ Breakout Session #2

Global companies spend $90B a year on analytics and surveys trying to understand customers’ expectations and decisions. How can companies shift their perspective away from cold, transactional data to the truth behind what’s on customers’ minds now to better understand their purchase decisions? Join the CEO of Worthix who will detail case studies and give you tips on how you can use AI-powered, Voice of the Customer technology to help streamline your interation process to better follow what your customers want from your business.

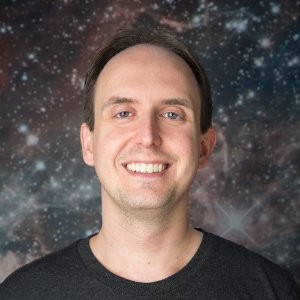

Navin leads Mayfield as Managing Partner. Under his leadership, Mayfield has raised eight U.S. funds and guided over 80 companies to positive outcomes. He has been named a Young Global Leader by the World Economic Forum and has ranked on the Forbes Midas List of Top 100 Tech Investors seventeen times, including being named in the Top Five in 2020, 2022, 2023, and 2024. Navin’s investments have created over $120 billion in equity value and over 40,000 jobs. During his venture capital career, Navin has invested in over 60 companies, of which 18 have gone public and 27 have been acquired. Navin was one of the earliest Silicon Valley investors to leverage the promise of tech in India. He is Vice Chair of the Stanford Engineering Venture Fund and advisor to Neythri.org. Navin is an active philanthropist dedicated to supporting education, expanding opportunities for underrepresented communities, and addressing food insecurity. As an entrepreneur, Navin has co-founded or led three startups including VXtreme: a streaming media platform, acquired by Microsoft to become Windows Media; Rivio/CPA.com: a SaaS provider for small businesses, and iBeam Broadcasting (NASDAQ:IBEM): a streaming media content delivery network. Navin holds an MS degree in electrical engineering from Stanford University and a B.Tech degree in electrical engineering from IIT Delhi, where he was honored with the distinguished IIT Alumni Award.

Navin's Sessions

Getting to Yes and What Happens Next: An Unfiltered Chat with a Top VC @ Breakout Session #2

Over the last decade, Navin Chaddha, 14-time Midas lister & early-stage investor in Lyft, Poshmark & HashiCorp, has led Mayfield as it invested in over 100 inception stage companies in the consumer, enterprise, human/planetary health and web3 sectors. Attend a candid conversation with him to ask your questions and to hear what he looks for when he writes that first check, as well as the key company building steps that come next. He’ll share insights on managing the fundraising process during a downturn, inspiring and convincing VCs with your vision, assembling your board and more.

Josephine Chen is a Partner on the early stage team at Sequoia, where she works with seed and Series A companies in enterprise software, fintech, and crypto. She works with companies such as Found, Magic Eden, Benchling, and Anrok. Prior to Sequoia, Josephine worked at Emergence Capital and McKinsey.

Josephine's Sessions

TechCrunch Startup Battlefield – Session 1

TechCrunch’s iconic startup competition is back, as entrepreneurs from around the world pitch expert judges and vie for the Startup Battlefield Cup and $100,000.

Carolyn Childers is the Co-Founder and CEO of Chief, the private network built to drive more women into positions of power and keep them there. She is an experienced leader and operator, having successfully scaled several early-stage businesses. Prior to founding Chief, Carolyn was SVP of Operations at Handy, then led the launch of Soap.com and acted as GM through its acquisition by Amazon. Carolyn was named to Inc.’s Female Founders 100 List.

Carolyn's Sessions

Yes, Chief

Chief’s stamp of approval has an obvious allure. The professional network is dedicated exclusively to driving more women into positions of power and keeping them there, charging thousands for a private membership (if you’re lucky enough to get accepted). It’s a pitch that has landed over 15,000 members and, most recently, a billion dollar valuation as of March 2022. At Disrupt, co-founders Carolyn Childers and Lindsay Kaplan will speak to what’s propelled Chief’s growth in just three years, the challenges along the way, and how to strategize something as subjective and elusive as community.

Quentin Clark, managing director at venture capital firm General Catalyst, focuses on investing in enterprise software and platforms that are transforming the workplace. He has made investments in Aviatrix, Eightfold, Glean, Lessen, Neon, Percent, TripleBlind and several yet to be announced companies. He was an early investor into and is on the boards of Coda, Commure, Minio and ThoughtSpot. Prior to joining GC, Quentin was CTO at Dropbox (NASDAQ: DBX), where he led the company’s engineering, product, design, and growth teams. Prior to Dropbox, he was CTO at SAP, and previously spent two decades with Microsoft leading the entire family of data products. Quentin received a BS at the University of Massachusetts at Amherst.

Quentin's Sessions

Talent Has Changed Forever: A CEOs Playbook to Building and Retaining Tomorrow's Distributed Workforce

The modern workforce is in the middle of one of its biggest shifts since the industrial revolution. Businesses have encountered the rise of global talent pools and entirely new sets of jobs and skills needed to grow. Now, they need to completely rethink how they source, train, equip, motivate, and reward workers.In this session, we will explore strategies, systems and tools around building the ‘human enterprise” in this decade. Global VC firm General Catalyst will reveal the technology innovation needed to create successful and enduring businesses that promote thriving cultures in the new global, remote working world.Quentin Clark, General Catalyst Managing Director and former Dropbox CTO will discuss the needs of the modern hybrid workforce with Sophie Ruddock, VP and GM North America at Multiverse. They will explore a world in which the Chief Human Resource Officer is becoming the new Chief Growth Officer and talent retention is as critical as customer retention. A whole new era of innovation around workforce transformation is just beginning. We’ll explore what work in the human enterprise looks like in 2030.Talent Has Changed Forever. Attendees will take away a playbook to build and retain tomorrow’s distributed workforce.

Parker Conrad is a three-time entrepreneur leading his latest venture as Co-Founder and CEO of Rippling, the first way for businesses to manage all of their HR, IT, and Finance—payroll, benefits, computers, apps, corporate cards, expenses, and more—in one global workforce platform. Formerly he was Co-Founder and CEO of Zenefits and SigFig.

Parker's Sessions

Going Global

Rippling co-founder Parker Conrad will reveal the workforce platform’s plans to expand internationally. He will also give founders an inside look into how Rippling’s “compound startup” model allowed it to build an entire infrastructure-as-a-service solution with a swat team of engineers.

As global program manager in the Office of Disability Inclusion, Beth works closely with senior leaders across the firm to develop and execute strategies, processes, tools and resources to better support employees with disabilities, those who care for disabled family members and small business founders with disabilities. Her work is aimed at removing barriers and changing culture – helping to shape a work- and marketplace where individuals with disabilities are viewed as leaders. Beth joined JPMorgan Chase’s Diversity & Inclusion team in 2010, where she led the establishment of the Office of Disability Inclusion. She transitioned to the Office once it was formally launched in June 2016. Beth was also the liaison for the Access Ability Business Resource Group during this time. She serves on the Corporate Advisory Board for Disability:IN. An advocate for people with disabilities throughout her life, Beth draws on her lived experiences with neurodiversity and mental health. She lives outside of Atlanta, GA and is the mom of four children, all with special needs – including triplets who were adopted from the foster care system. Beth received a Master’s degree in Comparative Political Science, with a concentration in Public Policy and Social Movements, from the University of Kentucky and a Bachelor of Arts from Wheaton College in Massachusetts.

Beth's Sessions

Accessibility in Startups – What does being inclusive really mean? @ Breakout Session #1

People with disabilities face unique barriers and deal with systemic discrimination akin to other underrepresented groups, creating the greatest untapped resource globally. Yet the lived experiences of people with disabilities make them innately adept entrepreneurs and team members, with diverse perspectives that foster innovation and inclusion at startups. In this session, we will address the following questions and more: How can we create opportunities to harness the innate entrepreneurial skills of disabled people? Why is it important to include board/team members with disabilities? Why is it critical for startups to consider accessibility and inclusion when developing their products and services?

Paul is the CEO and co-founder of Clubhouse, a social network based on voice. Prior to Clubhouse, Paul was the CEO and founder of Highlight (a location-based social network acquired by Pinterest), an Entrepreneur-in-Residence at Benchmark, and part of the early team at Metaweb (a graph search startup acquired by Google). Paul holds a BS in Industrial Engineering from Stanford University and an MBA from Stanford’s Graduate School of Business, where he was an Arjay Miller Scholar. He lives just outside San Francisco with his wife and three young kids.

Paul's Sessions

Founder Fireside: Clubhouse

Few startups had as much hype – and early consumer buy-in – as Clubhouse. Since its mega-hit introduction, however, it has seen its service copied by a host of competitors while working to expand and fine-tune its model. TechCrunch will sit down with Clubhouse co-founder and CEO Paul Davison to talk about the company’s past, present, and future.

Daniel Day

Head of Marketing, Monte CarloDaniel Day is currently Head of Marketing at Monte Carlo, the Data Observability Platform built to accelerate the world’s adoption of data by reducing data downtime. Before joining Monte Carlo, Daniel helped to build and scale Marketing, ABM, and Demand Generation functions at several fast-growing bay area startup companies in the data and AI space including Snowflake, Scale AI and Rollbar. Daniel is passionate about building data-driven and data-enabled marketing teams and creating better marketing experiences through the use of data.

Daniel's Sessions

All Weather Marketing: How to Weather the Storm and Win Market Share

Marketers have always needed to make good decisions, but marketers especially in today’s environment. They are being told to cut, pause, or change advertising campaigns…but is there any data to support those recommendations? We believe the short answer is “no” and there is strong evidence to the contrary. In this session, we will arm you with research and approaches to make the case for driving growth in any economic situation. Plus, we’ll have a fireside chat on how startups and founders are capitalizing on the growth opportunity.

Chris's Sessions

Bankrolling the Blockchain with a16z Crypto

Venture firm Andreessen Horowitz (a16z) is the largest and one of the best-known funding sources for web3 startups. Alongside a16z founder Marc Andreessen, general partner Chris Dixon has been integral to the firm’s rise as a giant in the crypto VC world — he was an early investor in startups including Coinbase, Uniswap and Oculus VR. Hear from Dixon about how a16z crypto is putting its massive $7.6 billion pool of capital to work by backing early-stage web3 companies.