-

Tesla by the numbers: Full-year comparison

And now the full-year figures. Once again, this is a quick glance at some key figures from the full-year 2024 results compared to the full-year 2023 earnings report.

- 2024 revenue: $97.69 billion vs. $96.77 billion in 2023

- 2024 net income: $7.09 billion vs. $14.9 billion in 2023

- 2024 operating income: $7.08 billion vs. $8.89 billion in 2023

-

Tesla by the numbers: Q4 2024 vs. Q4 2023

Tesla’s Q4 results just dropped and here is the quick and dirty. These are fourth-quarter earnings compared to the same period in 2023.

- Q4 revenue: $25.7 billion versus $25.17 billion in Q4 2023

- Q4 net income: $2.3 billion versus $7.9 billion in Q4 2023 (the 2023 figure included one-time non-cash tax benefit of $5.9 billion)

- Q4 operating income: $1.5 billion versus $2.06 billion in Q4 2023

-

The Megapack sweetener and other analyst musings

Speaking of analyst expectations, the folks at Bloomberg Intelligence had some interesting ideas about Tesla earnings and its business.

Bloomberg Intelligence analysts think Tesla’s Megapack gains might present as a sweetener in Q4.

“The ramp-up of its Megapack battery plant in Shanghai — almost doubling storage deployment to 60 gigawatt-hours — will likely boost future earnings, with an estimated 30% gross margin outperforming the auto segment,” analysts Steve Man and Peter Lau wrote.

They noted that Tesla’s updated Model Y launch and much-anticipated new, more affordable model will expand market reach, but they don’t expect to see the impact of that on the balance sheet until late 2025.

“A production decline in the quarter may suggest preparation for a Model Y refresh,” they wrote.

Other expectations from Bloomberg Intelligence:

- Cybertruck’s drag on Tesla’s margins in Q4 will likely extend through the year.

- A meaningful top-line volume boost will be dependent on whether Tesla can scale its new, cheaper vehicle post-2025.

- Today’s earnings call will build on the Tesla “We, Robot” event, with investors likely to ask questions about the rollout of Tesla’s sub-$30,000 vehicle, the Cybercab.

-

What Tesla analysts expect

With earnings almost here, it’s worth reminding ourselves of what analysts expect from Tesla’s Q4 and full-year earnings.

Analysts polled by Yahoo Finance expect Tesla to deliver $27.13 billion in revenue for the fourth quarter and $99.53 billion for the full year of 2024. That would be a marginal improvement from the $25.18 billion Tesla reported in the third quarter of 2024 and $96.77 billion reported for 2023.

From the lens of profitability, Wall Street expects an adjusted EPS (earnings per share) of 77 cents for the fourth quarter and $2.48 for the year.

-

How many sleeping caps can Musk wear?

Image Credits:aul Loeb-Pool / Getty Images One of the questions on the minds of Tesla shareholders heading into tonight‘s call is whether Musk is stretching himself too thin by so deeply involving himself in the Trump administration.

Now Wired is out with a report saying that Musk is spending so much time trying to shred the government to pieces that he’s sleeping in the offices of DOGE. It seems like just yesterday Musk was sleeping on the floor of the Fremont, California, factory. -

Growth stalls

A reminder of just how abnormal the circumstances are as we get closer to tonight’s festivities: This will be the first time Tesla has held an earnings call following a year-over-year drop in vehicle deliveries since it started mass-producing EVs more than a decade ago.

Musk once promised Tesla would grow an average of 50% each year. It was already off that trend before 2024, but last year really killed the momentum:

-

Tesla bingo — let’s play

I haven’t played Tesla bingo in some time, but it feels right today. What is Tesla bingo? A decade ago, some intrepid reporters, bloggers, and other industry watchers would create bingo cards ahead of Tesla’s earnings call. The card would be filled with Elon’s fave catchphrases or words. This is one I created back in 2018.

Here are a few phrases that are on my bingo card. What is on yours?

- Not many people understand this

- Order of magnitude

- Fork in the road

- DOGE

- Cybertruck

- Manufacturing is hard

- Dojo

- DeepSeek

-

Robotics and AI, oh my!

I expect we will hear a LOT about robotics and AI tonight. Tesla spent the morning posting as much. The AI-focused account run by the company posted a video on X that showed cars coming off the manufacturing line in Fremont and driving themselves to the lot where they’re prepped for delivery.

Musk and other Tesla executives shared the post and positioned it as a triumphant development. But I’m left wondering why Tesla wasn’t already doing this? The cars are only going a mile on private roads and surfaces that Tesla owns. It’s about as unchallenging an environment as autonomous software can find.

-

Tesla boycotts are popping up

Tesla has spent the last two years slashing prices to keep its sales up, so it wasn’t exactly a surprise that the company actually saw overall deliveries drop in 2024 compared to 2023.

The company has also been dealing with a perception problem as Musk has waded deeper into far-right politics. He only made that worse earlier this month when he did a fascist salute onstage the day before Trump’s inauguration. Now it could start affecting sales.

Musk faithful have tried to explain it away (poorly, IMO). But it’s led to more calls for a boycott on Tesla vehicles. German executives denounced Musk’s behavior and swore off buying Tesla cars, and now Poland’s minister of Sports and Tourism called on his country’s citizens to do the same.

-

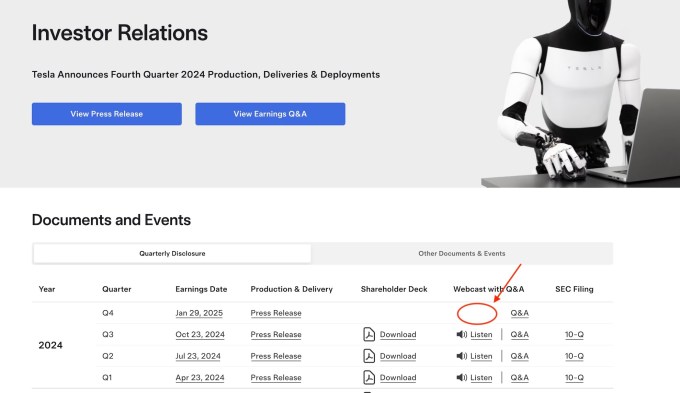

How to tune into Tesla’s earnings webcast

Everyone from EV fanatics to AI pundits and all the analysts in between are eagerly awaiting Tesla’s fourth-quarter and full-year 2024 earnings report. And here is how to find the webcast, which is scheduled to kick off at 5:30 p.m. ET.

Head over to Tesla’s investor relations page and migrate over to quarterly disclosures. Before the event, you’ll see a link under “Webcast with Q&A” that says “Listen.” Click that and follow the prompts, and enjoy the electronic waiting room music until the financial reporting begins.

Tesla typically broadcasts its earnings calls on YouTube as well, which you can find here.

And if you miss the live call, Tesla posts an archived version of the webcast on both its website and YouTube page two hours after the Q&A session.

-

What we’re paying attention to today

Image Credits:Bryce Durbin/TechCrunch Tesla earnings day is upon us — the quarterly check-in with one of the world’s largest EV makers and its controversial CEO, Elon Musk. What’s in store? We never really know, but we have a list of items we’ll be watching, and listening, for.

Keep in mind this is the first earnings call under a new Trump administration, which Musk is deeply aligned with. Check out this article for a recap on important financial figures from previous earnings as well as what to look out for. On our list: AI, those mystery EVs, and robotaxi ambitions.

Tesla earnings live updates: Promising ‘return to growth’ and cheaper cars

Tesla’s fourth-quarter and full-year earnings day is here — a highly anticipated report that is expected to be released after market close Wednesday. Tesla management, which will likely include CEO Elon Musk, will hold an earnings call at 5:30 p.m. ET.

This is the company’s first earnings call since Musk took a prominent role in the U.S. government under the Trump administration.

Follow our live updates before, during, and after earnings drop for all the latest insights and news from Tesla.

Topics